"You will can get notification in to your G mail ,when we are upload our new article . so you can follow this blog site. you can see "blank line" on the top line of the blog page, type your gmail and then submit. "

Consignment account

Consignment account is prepared to ascertain the profit earned or loss incurred by the consignor on a specific consignment. This account can be viewed as a combined trading and profit and loss account prepared specifically for consignment business.

The nature of the consignment account is nominal which means it is drawn up to show the results of the consignment business for a specific period.

If consignor sends goods to more than one consignees working in different cities or areas, a separate consignment account is required for each consignment so that the profit or loss for each consignment can be determined separately. If consignor maintains more than one consignment accounts, he can distinguish them from each other by adding to the account title the name of the consignee or the name of the city or area to which the particular consignment belongs. For example, Consignment to David, Consignment to John, Consignment to Ottawa and consignment to New York etc.

Debit and credit entries in a consignment account

The entries in the consignment account are made on the basis of consignor’s own record as well as account sales sent by the consignee. The debit and credit entries are made as follows:

Debit entries

The common entries that appear on the debit side of a consignment account are listed below:

- Opening stock of goods (if any)

- Total cost of goods sent on consignment

- All the expenses incurred by consignor such as loading, freight, insurance etc.

- All the expenses paid by consignee such as unloading, freight, godwon rent, warehousing and storage, marketing expenses, packaging and selling expense etc.

- Bad debts regarding consignment sales.

- Consignee’s ordinary and del credere commission at agreed rate on sale proceeds.

Credit entries

The usual items that appear on the credit side of a consignment account are listed below:

- Gross sale proceeds

- Closing stock of goods (if any)

- Abnormal loss of goods

- Stock in transit (if any)

The balance of consignment account represents a profit or a loss on consignment and is transferred to “Profit and Loss on Consignment Account“. The consignment account is thus closed.

The Profit and Loss on Consignment Account is also a nominal account. If there are more than one consignments, the balances of all consignment accounts are transferred to this account.

The profit and loss on consignment account is closed at the end of the year by transferring its balance to the General Profit and Loss Account.

Format and example

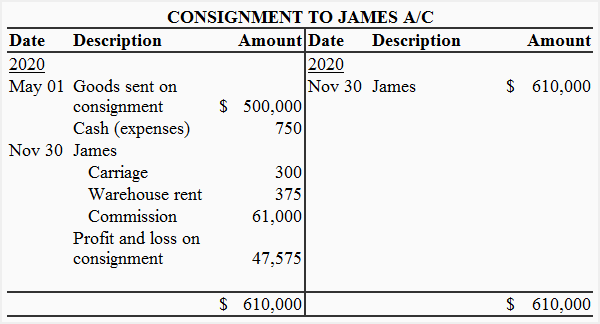

Example 1

In this example, consignor sends goods to Mr. James who is located in Ontario city. The consignee’s name in account title distinguishes this consignment account from others.

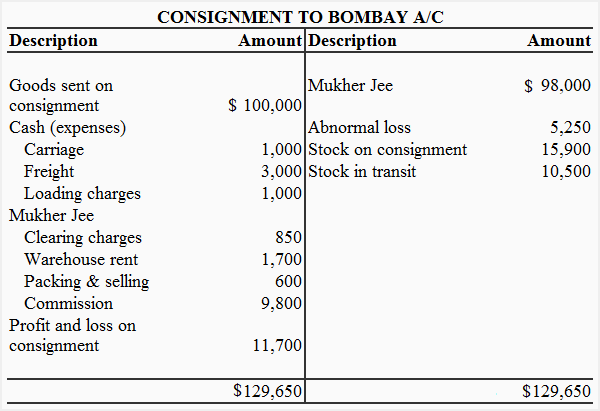

Example 2

This consignment is sent to Mukher Jee in Bombay city. The city name included in the account title distinguishes it from other consignments.

Journal entries in the books of consignee

In consignment, the status of consignee is that of a commission agent. His income is the commission which he receives from consignor for the sale of goods dispatched to him. He has no share in the consignment profit because he is not a business owner. Similarly, he is also not responsible for any loss incurred by the consignment business.

Any expenses incurred by the consignee in connection with the consignment are reimbursed to him.

Journal entries and ledger accounts in the books of consignee

Journal entries:

We will first discuss the journal entries in the books of consignee and then talk about the necessary ledger accounts. The common journal entries that a consignee makes in his books are given below:

1. Entry at the time of receiving goods:

No entry

The consignee holds goods on behalf of and on account of consignor. He does not make an accounting entry when he receives the goods consigned to him. He may however, keep the record of goods received in a separate book known as consignment inward book.

2. Entry at the time of making advance to the consignor:

(i). if payment is made in cash or via check or bank draft:

Consignor A/C [Dr]

Cash/Bank A/C [Cr]

(ii). If a bill is accepted as a mode of advance payment:

Consignor A/C [Dr]

Bill payable A/C [Cr]

3. Entry at the time of making payment for consignment related expenses:

Consignor A/C [Dr]

Cash/Bank A/C [Cr]

4. Entry at the time of sale of goods:

(i). If goods are sold for cash:

Cash/Bank A/C [Dr]

Consignor A/C [Cr]

(ii). If goods are sold on credit

See del credere commission and credit sales article

5. Entry for recording commission income:

Consignor A/C [Dr]

Commission received A/C [Cr]

6. Entry at the time of sending remittances:

Consignor A/C [Dr]

Cash/Bank A/C [Cr]

7. Entry to close commission received account to profit and loss account:

Profit and loss A/C [Dr]

Commission received A/C [A/C]

Points to remember:

- At the end of the accounting period, if consignor’s account shows a debit or credit balance, it should be presented in the balance sheet. Debit balance is shown as sundry debtors under the head current assets where as credit balance is shown as sundry creditors under the head current liabilities.

- No entry regarding the stock on consignment is passed in the books of consignee. As mentioned earlier, the consignee just holds the stock; the ownership to goods rests with the consignor.

- The consignee does not calculate profit or loss on consignment.

- The commission received account in the books of consignee is closed to the profit and loss account at the end of the year. It is done by making the journal entry 7 given above.

Ledger accounts:

The two ledger accounts that are important in the books of consignee are consignor account and commission received account. The consignor account is a personal account in nature. It tells consignee what balance is due to the consignor after deducting his commission and expenses from the sales proceeds. The commission received account is used to keep a record of the commission income earned from consignment. Consider the following example:

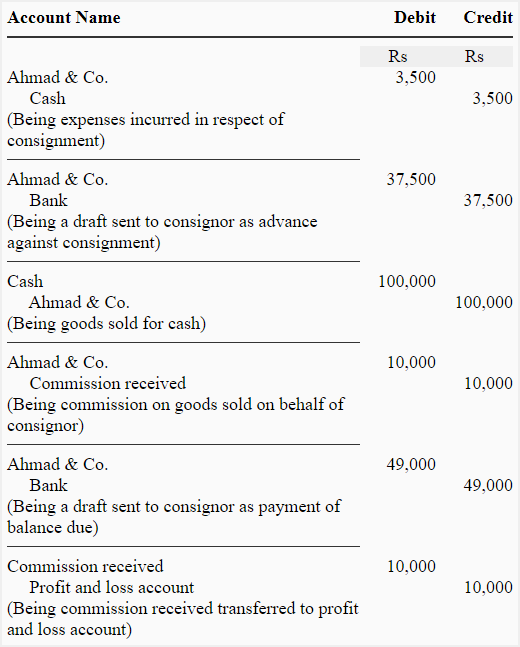

Example

Ahmad & Co. of Sialkot Consigned goods costing Rs 75,000 to Nasir & Co. of Karachi. Ahmad paid the following expenses:

- Loading charges: Rs 1,500

- Insurance: Rs 1,000

- Freight: Rs 5,000

Nasir & Co. received the delivery and transported the same to a rented godown. T paid the following expenses in respect of consignment:

- Unloading charges: Rs 1,000

- Carriage: Rs 2,000

- Godown rent: Rs 2,500

On the same day, Nasir sent a bank draft of Rs 37,500 to Ahmad as advance against consignment.

Nasir sold all the goods for Rs 100,000. His commission was 10% on gross sale proceeds. He paid the balance due via bank draft.

Required: Prepare journal entries and ledger accounts in the books of consignee.

Solution

Journal entries in the books of consignee:

Ledger accounts in the books of consignee:

Valuation of closing stock on consignment

Definition and explanation

A consignor may have some incomplete consignments at the end of his accounting year. An incomplete consignment means that there are some unsold units of goods with the consignee when the accounting period of the consignor comes to an end. These unsold units are termed as closing stock on consignment (or just stock on consignment for short) and need to be properly valued. After valuation, the stock on consignment must be brought into the books and credited to the consignment account so that the profit earned on consignment during the period can be computed correctly. The journal entry for this purpose is given below:

Stock on consignment A/C [Dr]

Consignment A/C [Cr]

The stock on consignment is an asset and is, therefore, shown on the year end balance sheet. In the next accounting period when consignment account is prepared, this stock appears as the first item on the debit side of this account. The following journal entry is made for this purpose:

Consignment A/C [Dr]

Stock on consignment A/C [Cr]

Valuation of stock on consignment

The stock on consignment, like in many other business situations, should be valued using lower of cost or market price principle. The major issue in this regard is the ascertainment of cost price and market price of goods in stock. The rest of this article talks about the procedures of determining these two prices. Let’s start with the cost price.

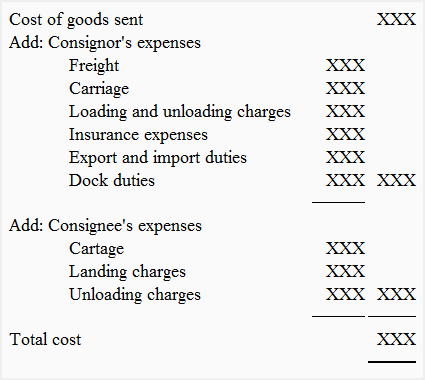

Cost price

The total cost of goods is equal to the expenditures incurred by consignor to bring the goods in salable condition plus all the expenditures paid by consignor as well as consignee in the course of transferring those goods to the consignee’s place. These expenditures usually include carriage, freight, insurance, import and export duties, loading and unloading expenses etc. These expenditures are popularly referred to as non-recurring expenditures.

Any expenditures incurred after the goods have reached to the consignee’s place should be ignored for the purpose of computing the value of closing stock on consignment. Usual examples of such expenditures include warehouse rent, warehouse insurance, storage expenses, carriage paid for the delivery of goods to customers, marketing expenses or any other payment made for the sale of goods.

Net realizable value (NRV)/market price

Net realizable value (NRV) of stock is determined by deducting from the market price of stock the possible expenses required to complete the sale of stock including consignee’s commission. Suppose, for example, 100 units of product X are in stock with a consignee and the sales price of one unit of product is $20. The total sales or market price of this stock would be $2,000 (= 100 units × $20). Now if the estimated expenses required to sell this stock are $300 and consignee’s commission on sale is $200, the net realizable value of stock would be $2,000 (= $2,500 – $500).

After computing the cost price and net realizable value (NRV) in accordance with the procedures explained above, the smaller one should be used as the value of closing stock. If no indication regarding the market price or net realizable value is available in an examination problem or a homework assignment, the students should assume that the cost price is lower than the net realizable value. The valuation of stock on consignment should therefore be done on the basis of cost price.

Formula and format for computing closing stock on consignment

For cost price

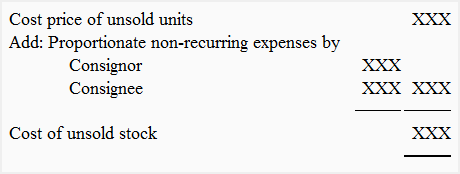

If cost price method is applicable, the students should follow the following format for computing the value of closing stock:

After computing the total cost using above format, the following formula can be used to find the value of stock on consignment:

Cost of stock on consignment = (Total cost/Total number of units) × Units in stock

Alternatively, the value of stock can also be computed as follows:

For net realizable value (NRV)

If net realizable value method is applicable, the following formula should be used to compute the value of stock on consignment.

Net realizable value = Market price of stock – (Expected expenses to be incurred to sell the stock + Consignee’s commission)

Example 1 – valuation using cost price

This example illustrates a situation where we need to take the cost of stock as the value of closing stock on consignment.

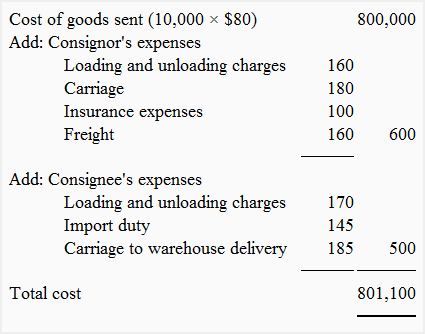

On June 1, 2020, Robert & Co. of Mexico consigned 10,000 units of goods to Peter & Co. of Ottawa at a cost of $80 per unit. Robert & Co. paid the following expenses:

- Loading and unloading charges: $160

- Carriage: $180

- Insurance: $100

- Freight: $150

The following expenses were paid by Peter & Co. on behalf of Robert & Co:

- Loading and unloading charges: $170

- Import duty: $135

- Carriage for delivering goods to consignee’s warehouse: $185

- Selling and marketing expenses: $110

- Warehouse rent: $125

The consignee’s commission was 5% on gross sale proceeds

On December 31, 2020, Peter & Co. sent an account sales to Robert & Co. sowing that 8,000 units were sold at a price of $110 per unit and 2,000 units remained unsold. The Robert & Co. prepares its profit and loss account and balance sheet on December 31 each year.

Required: Compute the value of closing stock on consignment on December 31, 2020.

Solution

Valuation of closing stock on consignment

Stock on consignment = ($801,100/10,000 units) × 2,000 units

= $160,220

Note: The selling and marketing expenses of $110 and warehouse rent of $125 paid by consignee have not been taken into account while determining the value of stock on consignment because these two expenses have been incurred after the goods have reached to the consignee’s place or warehouse.

Example 2 – valuation using net realizable value

This example illustrates a situation where we need to take the net realizable value of stock as the value of closing stock on consignment.

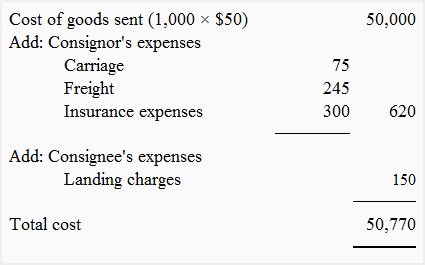

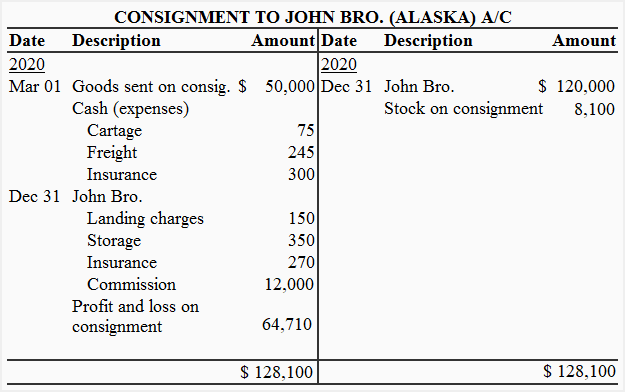

On March 1, 2019, David Bro. of Mumbai shipped to John Bro. of Alaska 1,000 units of a hunting tool costing $50 each. David Bro. incurred the following expenses for this shipment:

- Cartage: $75

- Freight: $250

- Insurance: $300

The following charges were paid by John Bro:

- Landing charges: $150

- Storage charges: $350

- Fire insurance premium on stock: $270

On December 31, 2019, an account sales was received from John Bro. revealing that 700 units were sold at $150 each.

Suddenly a new hunting tool appeared in the market towards the close of the year and it became impossible to sell the remaining 200 units at high price. The market price of the tool fell down to $45 per unit. The john bro. deducted all the expenses they paid in connection with the consignment and also charged a commission at an agreed rate of 10% on total gross sale proceeds.

A bank draft for the balance due was attached with the account sales.

Required:

- Find out the value of closing stock on consignment.

- Prepare a journal entry to bring the stock on consignment into books of David Bro.

- Prepare consignment to john account in the books of David Bro.

Solution:

1. Valuation of stock on consignment:

(i). Stock on consignment = ($50,770/1,000 units) × 200 units

= $10,154

(ii). Market price of stock – Consignee’s commission @ 10%

= (200 units × $35) – $700*

= $7,000 – $700

= $6,300

*7,000 × 10%

The net realizable value of stock ($6,300) is less than its cost ($10,154). The value of closing stock on consignment is, therefore, $6,300.

Note: The storage charges of $350 and fire insurance premium of $270 paid by consignee have not been taken into account while determining the value of stock on consignment because these two expenses have been incurred after the goods have reached to the consignee’s place or warehouse.

2. Journal entry

3. Consignment to John account

Del credere commission and credit sales

Definition and explanation

Del credere commission is related to credit sales. It is a type of commission which a consignor offers to the consignee who guarantees the collection of payment from credit customers. It is different from the consignee’s ordinary commission and works like a credit insurance to consignor in the event a customer becomes insolvent or fails to make payment due to some other reason. In consignment account, del credere commission appears on the debit side along with the ordinary commission allowed to the consignee.

Calculation of del credere commission

Del credere commission is paid to the consignee in addition to his ordinary commission. It is usually computed at a certain pre-agreed percentage of total gross sale proceeds. For example, the cash sales are $5,000 and credit sales are $2,500. If an ordinary commission of 10% and a del credere commission of 5% are allowed to consignee, the two types of commission would be computed separately as follows:

Ordinary commission = ($5,000 + $2,500) × 0.1

= $750

Del credere commission = ($5,000 + $2,500) × 0.05

= $375

The computation of del credere commission is similar to the computation of ordinary commission. However, the consignor and consignee may sign a separate agreement regarding the calculation and payment of del credere commission.

Students should remember the following two points:

- if del credere commission is not paid to the consignee, the consignor will bear the losses resulting from consignment related bad debts.

- if del credere commission is paid to the consignee, the consignee will bear the losses resulting from consignment related bad debts.

Entries related to credit sales

(1). When a del credere commission is not given to consignee

Entries in the books of consignor:

(1). At the time of credit sales:

Consignment debtors A/C [Dr]

Consignment A/C [Cr]

(2). At the time of collection of debtors:

Cash/Bank A/C [Dr]….Collection by consignor

Consignee A/C [Dr]…..Collection by consignee

Consignment debtors A/C [Cr]

(3). Entry for bad debts/discount allowed:

Bad debts/Discount allowed A/C [Dr]

Consignment debtors A/C [Cr]

(4). At the time of closing bad debts/discount allowed account:

Consignment A/C [Dr]

Bad debts/Discount allowed A/C [Dr]

Entries in the books of consignee

(1). At the time of credit sales:

No entry

(2). At the time of collection of debtors:

Cash/Bank A/C [Dr]

Consignor A/C [Cr]

(3) Entry for bad debts:

No entry

(2). When a del credere commission is given to consignee

Entries in the books of consignor

(1). When credit sales are made

Consignee A/C [Dr]

Consignment A/C [Cr]

(2). Entry for bad debts:

No entry – when del credere commission is allowed to the consignee, the consignor has nothing to do with bad debts.

(3). For consignee’s ordinary and del credere commission:

Consignment A/C [Dr]

Consignee A/C [Cr]

Entries in the books of consignee

(1). When credit sales are made:

Consignment debtors [Dr]

Consignor A/C [Cr]

(2). At the time of collection of debtors:

Cash/Bank [Dr]

Consignment debtors [Cr]

(3). Entry for bad debts:

Bad debts A/C [Dr]

Consignment debtors A/C [Cr]

(4). Entry for closing bad debts account

Consignee adjusts the amount of bad debts against his commission from consignment. The bad debts are debited to the commission received account. At the end of the year, the net balance of commission received account is transferred to the profit and loss account. This is done by means of the following two journal entries:

i. The following entry closes the bad debts account to commission received account:

Commission received A/C [Dr]

Bad debts A/C [Cr]

ii. The following entry closes the commission received account to profit and loss account:

Profit and loss A/C [Dr]

Commission received A/C [Cr]

credere commission

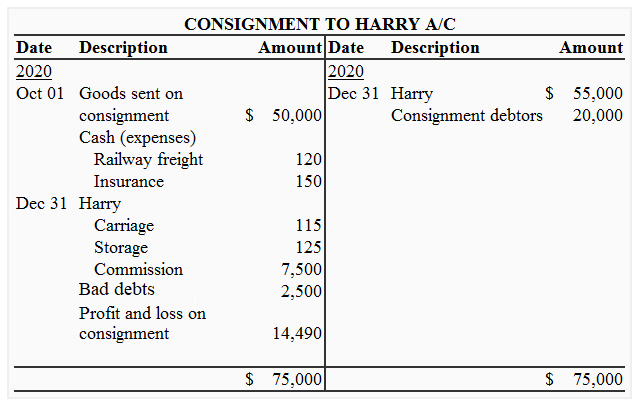

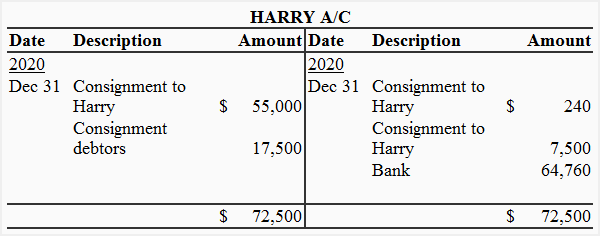

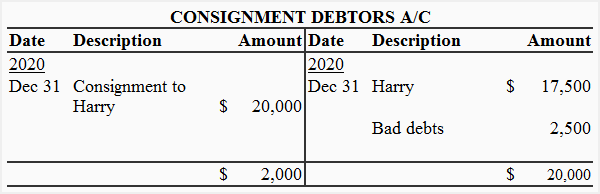

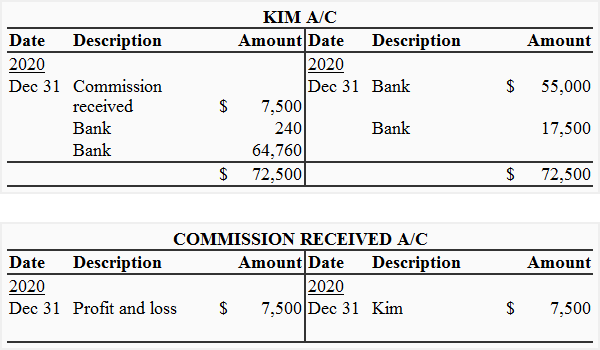

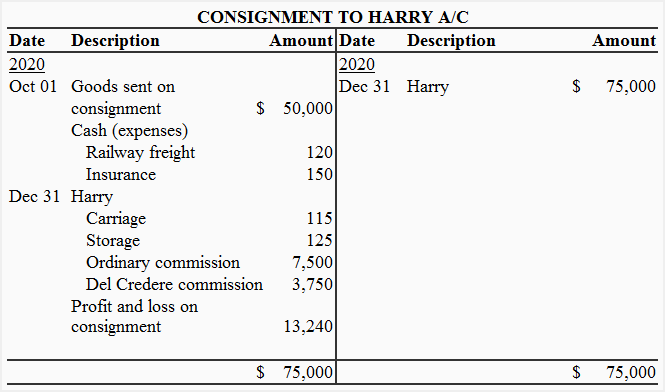

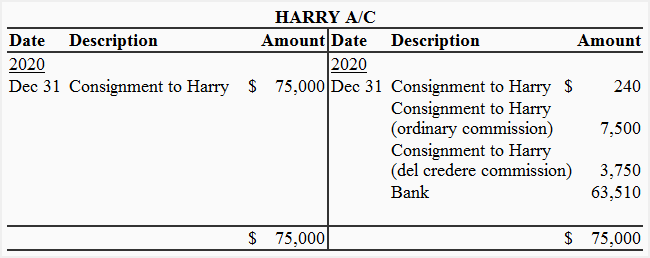

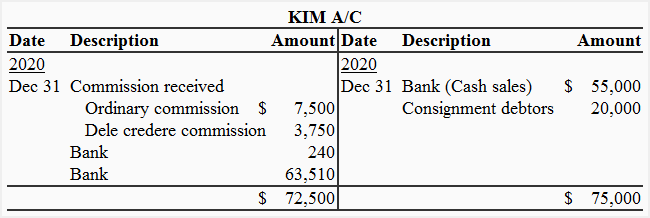

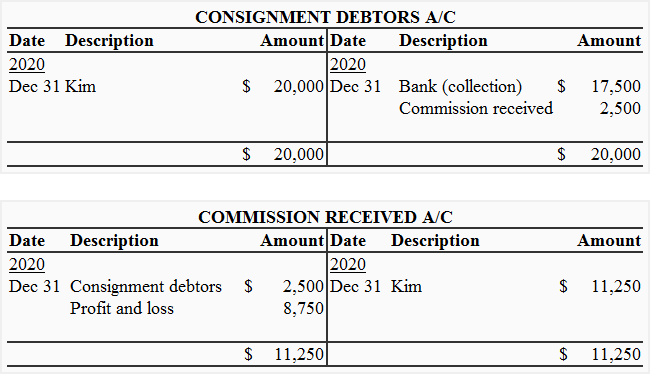

On 1st October 2020, Kim of Manchester consigned goods costing $50,000 to Harry of Bristol. Kim paid $120 as railway freight and $150 as insurance. On 31 December 2020, an account sales was received from Harry showing that all the goods were sold for $75,000 – out of which, $20,000 were sold on credit. Harry paid $115 as carriage and $125 as storage expenses.

A credit customer who purchased goods for $2,500 did not make payment and the debt proved bad. All other payments were successfully collected by Harry. The Harry was entitled to an ordinary commission of 10% on gross sale proceeds. A cross check was enclosed with the account sales for the balance amount.

Required:

- Draw up necessary ledger accounts in the books of Kim and Harry using above information.

- Disregard the requirement 1 and refer to the original information. Draw up necessary ledger accounts in the books of Kim and Harry assuming the Harry is given a 5% del credere commission (in addition to his ordinary commission). Other things remaining the same.

Solution

1. Where no del credere commission is given to Harry:

In the books of Kim (the consignor)

In the books of Harry (the consignee)

2. Where a del credere commission is given to Harry

In the books of Kim (the consignor)

In the books of Harry (the consignee)

Advance on consignment made by consignee

Advance on consignment is the amount which a consignee sends to the consignor in advance, either as security against goods received or as investment assistance for consignor. The amount is sent in the form of cash, check or a bank draft in favor of consignor. Alternatively, the consignee may also accept a bill of exchange drawn by the consignor on him for this purpose.

Where the consignee sends advance, the amount of advance is adjusted against the proceeds due from him. The method of such adjustment highly depends upon the purpose for which the consignor asks for the advance payment from consignee. The procedure is discussed and exemplified below.

Where the purpose of advance is not the security of goods

Where the purpose of advance is not the security of goods, the full amount of advance is adjusted against the amount due from consignee, even if some stock remains unsold with the consignee at the end of the period. The journal entries in this regard are made as follows:

In the books of consignor

1. Journal entry at the time of receiving advance from consignee:

Cash/Bank/Bill receivable A/C [Cr]

Advance against consignment A/C [Dr]

2. Journal entry for adjusting the amount of advance at the end of the period:

Advance against consignment [Dr] – With full amount of advance

Consignee [Cr]

In the books of consignee

1. Journal entry when advance is sent to consignor:

Advance against consignment [Dr]

Cash/Bank/Bill receivable [Cr]

2. Journal entry for adjustment of advance at the end of the period:

Consignor [Dr] – Full amount of advance

Advance against consignment [Cr]

Consider the example 1 given below which makes the adjustment procedure more clear.

Example 1

William of Liverpool sent goods costing $25,000 to Jackson of Glasgow on consignment basis. William incurred the following expenses:

- Loading: $200

- Freight: $500

Jackson took the delivery of goods and transported the same to godown. He paid the following expenses:

- Carriage: $130

- Godown rent: $120

Jackson sent a cross check for $10,000 to William as advance against consignment. According to account sales sent by Jackson, 3/4 of goods were sold for $35,000. A customer who purchased goods for $1,000 failed to pay and the debt proved bad. The consignee was allowed a 10% ordinary commission and 5% del credere commission on gross sale proceeds.

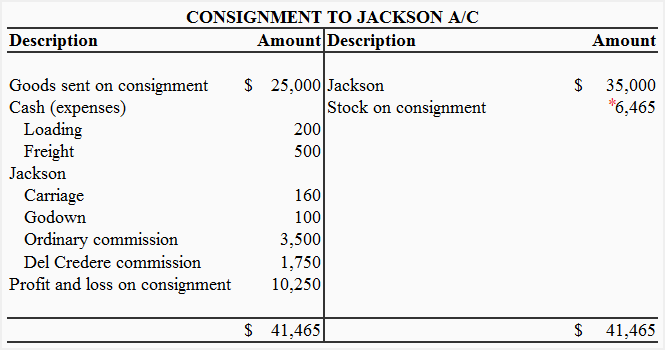

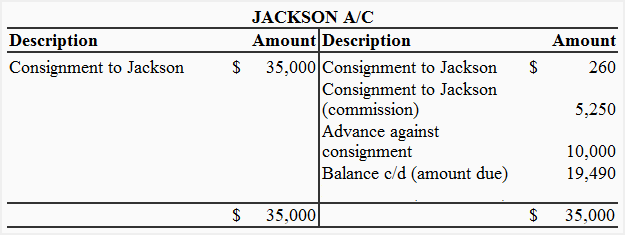

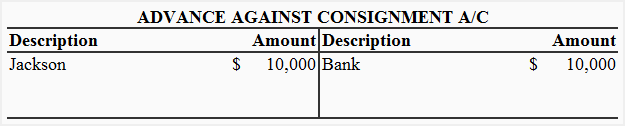

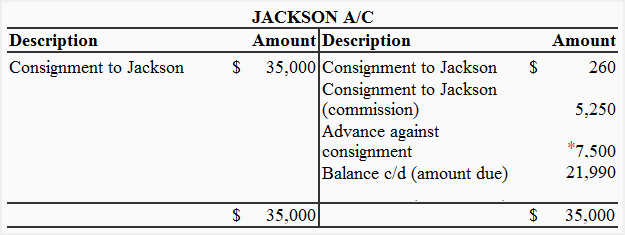

Required: In the books of William, prepare a consignment to Jackson account, Jackson’s personal account and advance on consignment account.

Solution

*Valuation of closing stock on consignment:

= ($25,000 + $200 + $500 + $160) × 1/4

= $6,465

Where the purpose of advance is the security of goods

Where the purpose of advance payment to consignor is the security of goods, the amount so sent must be proportionally adjusted against the amount due from consignee. For example, a consignee receives 500 units of goods from a consignor and sends him $5,000 in advance advance. If only 400 units are sold at the end of the period and the remaining 100 units are still held by consignee then only $4,000 [= ($5,000/500)×400] should be adjusted against the amount due from consignee.

The journal entries in respect of advance as security are be made as follows:

In the books of consignor

1. Journal entry at the time of receiving advance from consignee:

Cash/Bank/Bill receivable A/C [Cr]

Advance against consignment A/C [Dr]

2. Journal entry for adjustment at the end of the period:

Advance against consignment [Dr] – With proportionate amount of advance

Consignee [Cr]

In the books of consignee

1. Journal entry when advance is sent to consignor:

Advance against consignment [Dr]

Cash/Bank/Bill receivable [Cr]

2. Journal entry for adjustment of advance at the end of the period:

Consignor [Dr] – With proportionate amount of advance

Advance against consignment [Cr]

Consider the example 2 given below for a better understanding.

Example 2 – advance as security of goods

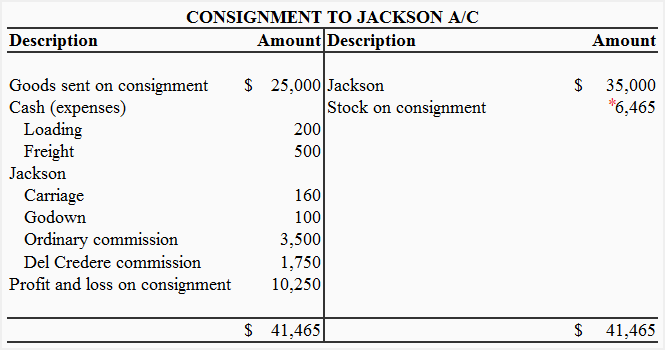

Refer to the data given in example 1 and assume that the cross check of $10,000 sent by Jackson is an advance against the security of goods on consignment.

Required: In the books of William, prepare consignment to Jackson account, Jackson’s personal account and advance against consignment account.

Solution

*Valuation of stock on consignment:

= ($25,000 + $200 + $500 + $160) × 1/4

= $6,465

*Adjustment for advance against consignment:

The advance was sent as security against consignment. Therefore, $7,500 (= $10,000 × 3/4 ) would be adjusted against the amount due from consignee.

Notice that the advance against consignment account shows a balance of $2,500 which is proportionate to the unsold stock on consignment

Normal and abnormal loss in consignment

A part of the goods sent on consignment may possibly be lost or otherwise damaged while the goods are in transit or they are in consignee’s godown. It is the consignor who bears the loss because, in consignment model of business, the ownership to goods remains with the consignor and does not pass to the consignee. To understand the correct accounting treatment in the books of consignor, the loss on consignment must be classified as normal and abnormal.

In the rest of this article, we would see how normal and abnormal losses differ from each other and how they are treated in accounting for consignment.

Normal loss – meaning and treatment

Normal loss occurs majorly due to natural causes like drying, evaporation, leakage, shrinkage or perishing a few items due to handling goods in bulk quantities. It is an unavoidable or inevitable loss and we cannot avoided it by any effort.

Normal losses are mostly related to the nature or type of the goods being handled or moved from one place to another. These losses are highly expected in many industries and generally have a higher degree of acceptance as compared to abnormal losses.

In consignment, the normal loss is ignored which means its value is absorbed by remaining good units in the stock. For example, A consigns 1,000 units of goods costing $9,500 to B. The per unit cost of consignment is $9.5 (= $9,500/1,000 units). Suppose a normal loss of 50 units occurs and consignee receives 950 units. The increased per unit cost after normal loss would be $10 (= $9,500/950 units) and the stock on consignment would be valued using this new unit cost.

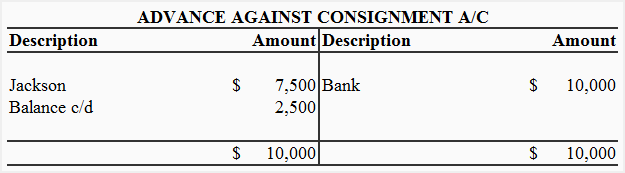

The students should remember the following two points while accounting for the normal loss in a consignment problem or assignment:

- If all the goods have been sold and nothing remains unsold in the stock, the normal loss does not require any treatment.

- If all the goods have not been sold and there remain some unsold units in the stock, the value of stock should be calculated using the following formula:

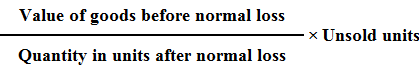

Example

On 1st September, 2020, Dravid sent 1,000 kgs of goods costing $30,000 to Sunny on consignment basis. Dravid incurred the following expenses for sending the goods:

- Loading: $200

- Insurance: $150

- Freight: $300

Sunny’s expenses regarding consignment were as follows:

- Freight and insurance: $250

- Godown rent: $100

- Selling expenses: $400

Sunny sold 800 kgs for $45,000. His ordinary commission was 10% on gross sale proceeds. No del credere commission was allowed to him.

The consignee observed a loss of 10 kgs which was quite natural and was to be treated as normal.

Required: Prepare a consignment account in the books of Dravid. The detailed calculation of closing stock on consignment should be the part of your answer.

Solution

*Calculation of stock on consignment:

= (Value of goods before normal loss/Quantity received after abnormal loss) × Unsold stock

= [($30,000 + $200 + $150 + $300 + $250)/990] × 190

= $5,930 approx.

.

Abnormal loss – meaning and treatment

The abnormal loss is avoidable in nature and generally arises due to reasons like fire, theft, accident or flood etc. In consignment, the value of abnormal loss is charged to profit and loss account and not to consignment account. The consignment account, in fact, is given a credit for the value of abnormally lost units so that true profit or loss of consignment can be computed.

In consignment accounting, the abnormal loss is generally handled using one of the two methods discussed below:

Method 1

1. Journal entry if the goods are not insured:

Profit and loss A/C [Dr]

Consignment A/C [Cr]

2. Journal entry if the goods are fully insured:

Insurance claim A/C [Dr]

Consignment A/C [Cr]

3. Journal entry if the loss is more than the compensation given by insurance company:

Profit and Loss A/C [Dr]

Insurance claim A/C [Dr]

Consignment A/C [Cr]

4. Journal entry when the amount of claim is received from insurance company:

Bank A/C [Dr]

Insurance claim [Cr]

Method 2

Under second method, the abnormal loss is dealt through a special account known as “abnormal loss account”. When abnormal loss occurs, its entire value is transferred to abnormal loss account. The journal entries under this method are as follows:

1. Journal entry to transfer the loss to abnormal loss account:

Abnormal loss A/C [Dr]

Consignment A/C [Cr]

2. Journal entry to close the abnormal loss account if goods are not insured:

Profit and loss A/C [Dr]

Abnormal loss A/C [Cr]

3. Journal entry to close the abnormal loss account if goods are fully insured:

Insurance claim A/C [Dr]

Abnormal loss A/C [Cr]

4. Journal entry if the loss is more than the compensation given by insurance company:

Profit and Loss A/C [Dr]

Insurance claim A/C [Dr]

Abnormal loss A/C [Cr]

5. Journal entry when the amount of claim is received from insurance company:

Bank A/C [Dr]

Insurance claim [Cr]

Formula for the calculation of abnormal loss

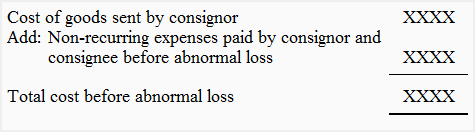

For computing the value of abnormal loss in consignment, we first need to compute the total cost of goods just before the occurrence of abnormal loss. It is done as follows:

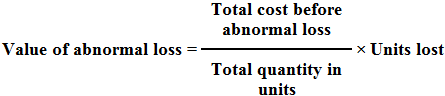

After the total cost of goods just the before abnormal loss has been obtained using above using above format, the value of abnormal loss can be ascertained by applying the following formula:

Consider the following example:

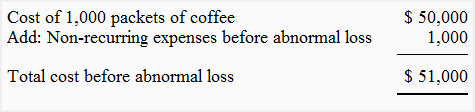

Example 1 – calculation of abnormal loss and closing stock

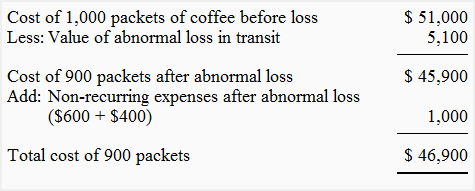

A consigned 1,000 packets of coffee costing $50,000 to B. A paid $700 for freight and $300 for insurance. While the goods were on their way to consignee, an accident occurred which completely destroyed 100 packets. B received the delivery of remaining 900 packets of coffee and transported them to a rented godown. B paid $600 as clearing charges, $400 as freight and insurance, $150 as godown rent and $200 as selling expenses.

800 packets were sold @ $75 per packet and 100 packets were still in stock at the end of the accounting period.

Required: Calculate the value of abnormal loss and the value of stock on consignment.

Solution

1. Calculation of abnormal loss:

Value of abnormal loss = ($51,000/1,000) × 100

= $5,100

The cost or value of 100 abnormally lost packets of coffee are $5,100.

2. Calculation of stock on consignment:

Value of stock on consignment = ($46,900/900) × 100

= $5,289 approx.

Example – normal and abnormal loss simultaneously

On January 1, 2019, PLC company of Toronto consigned 5,000 liters of olive oil, costing $12 per liter to Moon & Co of Ottawa. PLC incurred $500 as loading charges $1,500 as insurance and freight charges. On January 2, 2019, 150 liters of oil were destroyed in transit for which an insurance claim of $1,400 was settled and directly paid to the PLC on January 10. The Moon & Co. took delivery on January 3 and transported the goods to a rented godown. On the same day, they accepted a bill drawn on them by PLC for $30,000 for one month.

On January 31, 2019, Moon & Co. sent to PLC an account sales containing the following information:

4,000 liters of olive oil were sold @ $18 per liter. Unloading charges were $400, godown rent was $600, and selling and marketing expenses were $350. Due to leakage, a normal loss of 50 liters was observed. Moon & Co. was entitled to an ordinary commission of 10%. A check for the amount due was enclosed with the account sales.

Required: Show the following accounts in the books of PLC company:

- Consignment to Ottawa account

- Moon & Co. account

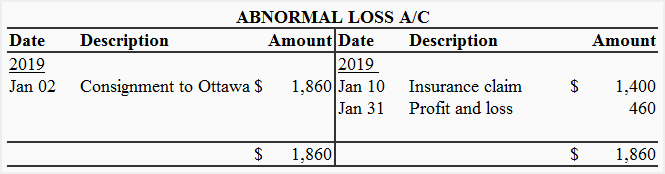

- Abnormal loss account

Solution

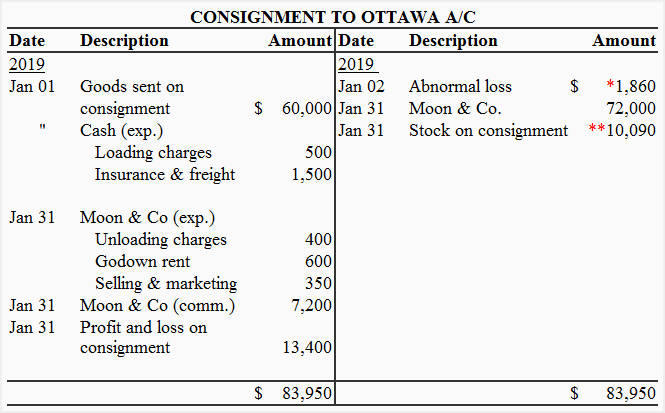

1. Consignment to Ottawa account

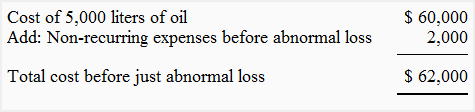

* Working note 1 – calculation of abnormal loss in transit:

Value of abnormal loss = (62,000/5,000 liters) × 150 liters

= $1,860

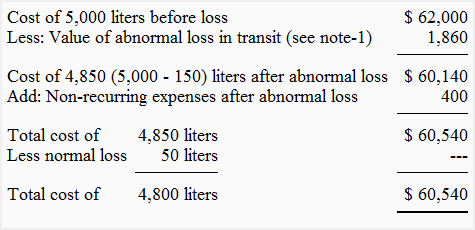

** Working note 2 – calculation of stock on consignment:

Value of stock on consignment = ($60,540/4,800 liters) × 800 liters

= $10,090

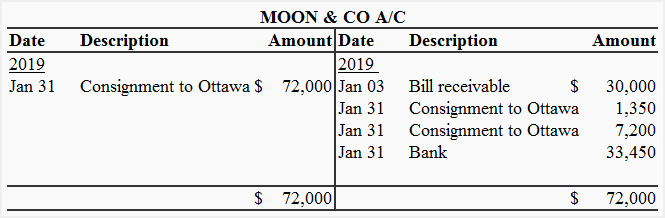

2. Moon & Co. account

3. Abnormal loss account

Overriding commission in consignment

Definition and explanation

Overriding commission is a type of commission which a consignor grants to the consignee who achieves a specific sales target or whose total sales revenue exceeds a specified amount. It encourages consignee to realize the best possible price for goods sold. Sometime it is given to consignee as an incentive for putting his efforts to introduce, promote and create market for a new product in certain areas.

Overriding commission is an extra commission which is awarded to the consignee in addition to his ordinary or regular commission. Consider the following example to understand how this type of commission is allowed and calculated:

Example

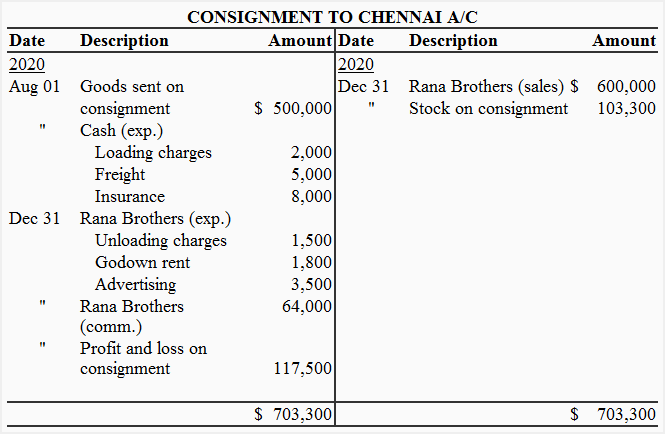

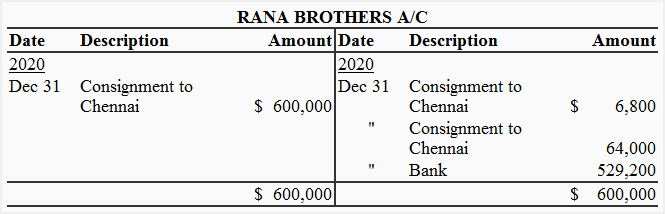

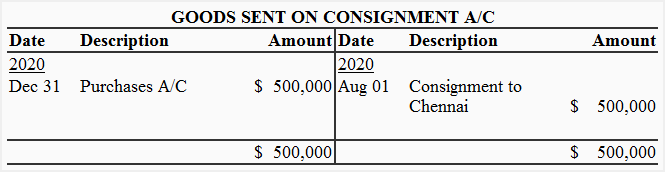

On 1st August, 2019, Ali Brothers of Kolkata sent on consignment to Rana Brothers of Chennai 1,000 packets of goods costing Rs 500 each and paid Rs 2,000 for loading, Rs 5,000 for freight and Rs 8,000 for insurance.

Rana brothers paid Rs 1,500 for unloading, Rs 1,800 for godown rent and Rs 3,500 for advertising. Rana brothers reported that 800 packets were sold for Rs 600,000. They were entitled to an ordinary commission of 10% on regular selling price and an overriding commission of 15% on any amount realized over and above the regular selling price. The regular selling price was Rs 650 per unit (i.e., cost plus 30%).

Rana Brothers sent payment for the balance due directly to the bank account of Ali Brothers via internet banking.

Required: Draw up consignment to Chennai account, Rana Brothers account and goods sent on consignment account in the books of Ali Brothers. (The detailed calculation of consignee’s commission and the value of stock on consignment should be the part of your answer).

Solution

1. Consignment to Chennai account:

Working note 1: Calculation of commission:

Ordinary commission + Overriding commission

= [(800 × 650) × 0.1] + [(600,000 – 520,000) × 0.15]

= [520,000 × 0.1] + [80,000 × 0.15]

= 52,000 + 12,000

= Rs 64,000

Working note 2: Calculation of stock on consignment:

= Cost of 200 units + Proportionate non-recurring expenses

= [(200 × 500) + (*16,500/1,000) × 200]

= 100,000 + 3,300

= Rs 103,300

*Non-recurring expenses: 2,000 + 5,000 + 8,000 + 1,500

2. Rana Brothers account:

3. Goods sent on consignment account:

Return of goods by consignee

If some part of goods is not saleable, the consignee may return the same to the consignor. When goods are returned by the consignee, the consignor records it in his books by making the following journal entry:

Goods sent on consignment A/C [Dr]

Consignment A/C [Cr]

Notice that the above entry is exactly the reverse of the entry that is made at the time when consignor consigns goods to the consignee.

Treatment of expenses on return of goods

The return of goods from consignee to consignor may involve some expenses like loading, unloading, freight and octroi duty etc. The cash for these expenses may be paid either by consignor or by consignee. However, like other consignment expenses, they are ultimately born by the consignor.

A difference of opinion exists regarding the treatment of returning expenses in the books of consignor. Some accountants argue that these are consignment related expenses and should be charged to the consignment account. Others say that the expenses arisen from returning of the goods are policy costs and should therefore be charged to the general profit and loss account, and not to the consignment account.

For the sake of simplicity, students are advised to follow the first approach and charge these expenses to the consignment account while solving an examination problem or completing their homework assignment.

The journal entry to be passed by consignor is given below:

(i). If expenses are paid by consignor:

Consignment account [Dr]

Cash/Bank [Cr]

(ii). If expenses are paid by consignee:

Consignment account [Dr]

Consignee [Cr]

Example

On 1st January 2020, Rani Traders of Darjeeling consigned 1,000 kgs of tea costing $10 per kg to Mahesh & Co. of Nagpur. Rani Traders incurred the following expenses:

- Loading: $100

- Freight: $200

- Insurance: $150

Mahesh & Co. found that 100 kgs of tea was of poor quality which they returned to the Rani Traders on 15 December, 2020. They paid the following expenses in respect of consignment:

- Unloading & carriage to godown: $100

- Godown rent: $50

- Packaging and advertising: $250

- Freight on returning 100 kgs to consignor: $50

Mahesh & Co. sold 800 kgs of tea @ $14 per kg. Their ordinary commission was 10% of sales. They deducted all the money spent for expenses as well as the amount of their commission and remitted the the balance to Rani Traders through wire transfer.

Required: Draw up the following accounts in the books on Rani Traders:

- Consignment account

- Mahesh & Co. account

- Goods sent on consignment account

Solution

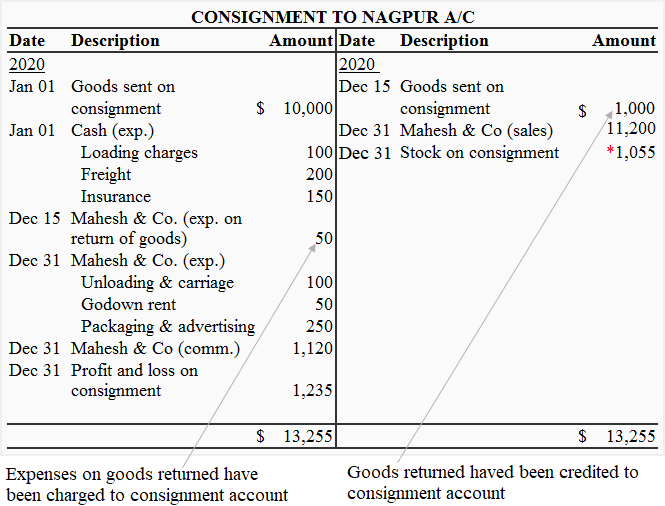

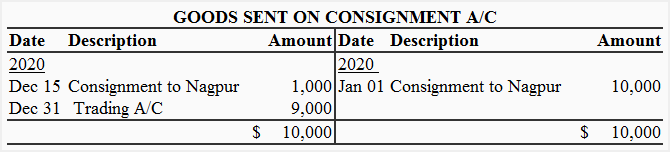

1. Consignment to Nagpur account

*Value of closing stock = Cost of 100 units in stock + Proportionate non-recurring expenses

= (100 units × $10) + [($550/1000 units) × 100 units]

= $1000 + $55

= $1,055

Proportionate non-recurring expenses: $100 + $200 + $150 + $100 = $550

2. Mahesh & Co account

3. Goods sent on consignment account

Invoice price method of consignment

Under invoice price method, the goods are consigned to the consignee at a price which is higher than their original cost. The proforma invoice is prepared by adding a certain percentage of the cost price or the sales price to the original cost of the goods. For example, A of Manchester consigns 1,000 boxes of goods to B of Glasgow on 1st June 2020. The cost per box is $50 and the proforma invoice is prepared to show a 20% profit on cost. In this example, the proforma invoice will be made at $60 (= $50 + 20% of $50) per box and the consignment account will be debited by $60,000, and not by $50,000.

The invoice price method is adopted to achieve one or more of the following purposes:

- Sending goods to consignee not at original cost but at a higher price helps keep the consignment profit secrete.

- It incentives consignee to realize the best possible price on sale of goods.

- It makes consignee charge uniform price to all the customers.

Journal entries under invoice price method

The preparation of journal entries and ledger accounts under invoice price method is much similar to the cost price method, except for some adjusting entries that are required to remove excess price on goods and bringing their value down to the cost. The removal of excess price or loading is essential to know the actual profit earned by the consignment.

The journal entries that are made in the books of consignor under cost price method have been given here. In this article, we will discuss only those entries that are required to eliminate the impact of excess price or loading.

1. Journal entry for adjusting the value of opening stock

Stock reserve [Dr]

Consignment [Cr]

2. Journal entry for adjusting the value of goods sent on consignment:

Goods sent on consignment [Dr]

Consignment [Cr]

3. Journal entry for adjusting the value of abnormal loss:

Consignment [Dr]

Abnormal loss [Cr]

4. Journal entry for adjusting the value of stock on consignment:

Consignment [Dr]

Stock reserve [Cr]

When balance sheet is prepared at the end of accounting period, the balance of the stock reserve account is shown as deduction from the value of stock on consignment.

When consignment account is prepared at the start of next accounting period, the balance of the stock on consignment account appears on the debit side and the balance of stock reserve account appears on the credit side.

Example

Arif & Co. of Delhi consigned 100 units of goods, costing $100 per unit, to their agent Gupta & Co. in Mumbai at a proforma invoice of 20% on cost. Arif & Co. paid the following expenses:

- Loading charges: $100

- Freight: $200

- Insurance: $300

Gupta & Co. took delivery of goods and, on the same day, they sent a bank draft of $5,000 to Arif & Co. as advance against consignment.

Gupta & Co. forwarded an account sales revealing that 75 units were sold @ $140 per unit. Their expenses in respect of the consignment were as follows:

- Unloading charges: $75

- Carriage: $25

- Godown rent: $60

Gupta & Co. was allowed a commission of 10% on gross sale proceeds.

Required: Prepare journal eateries and draw up consignment account in the books of Arif & Co.

Solution

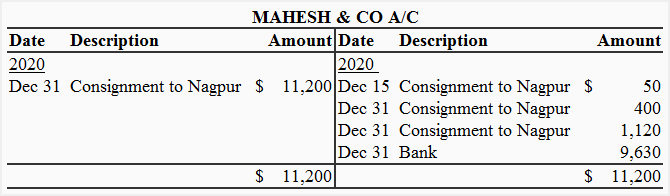

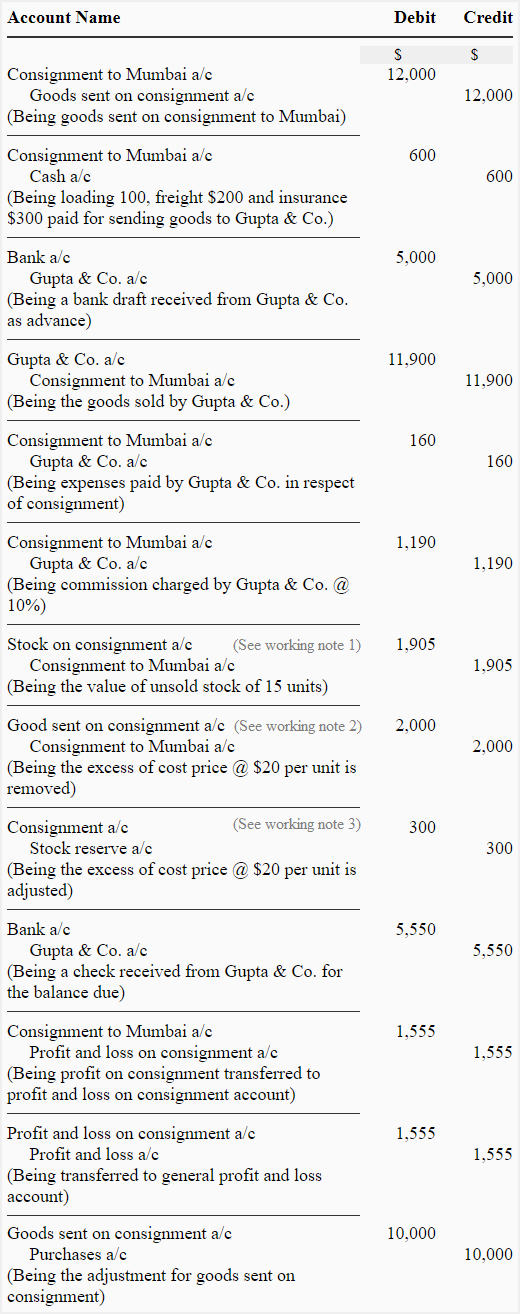

1. Journal entries in the books of Arif & Co:

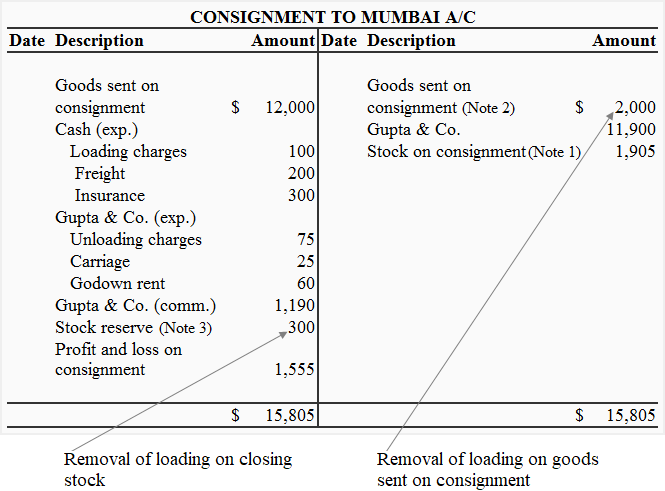

2. Consignment to Mumbai account

Notice that the loading on goods sent on consignment has been credited and the loading on closing stock has been been debited to the Consignment to Mumbai Account. This action removes the excess price that was added to the original cost of goods and is necessary to calculate the correct profit on consignment.

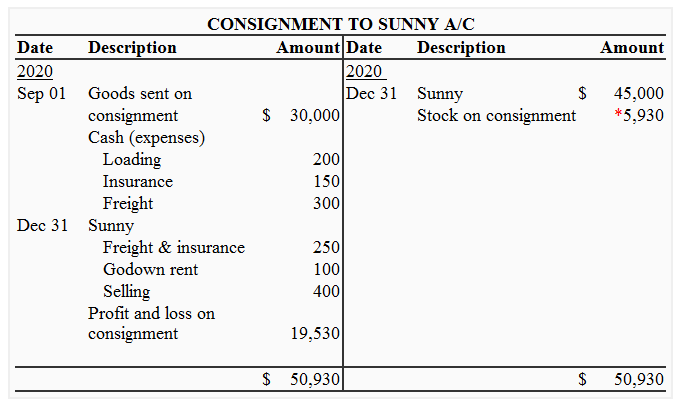

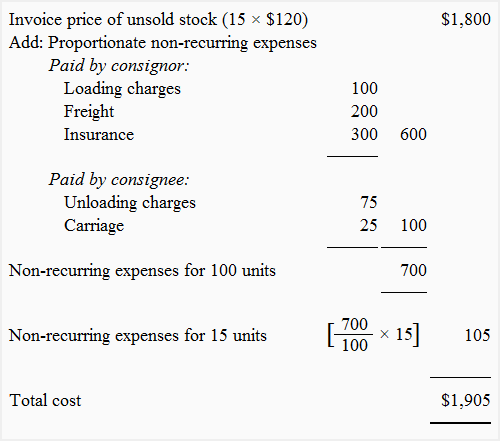

Working note 1: Calculation of stock on consignment:

Working note 2: Calculation of excess price or loading on goods sent:

The goods were consigned at cost plus 20%. The cost of 100 units @ $100 is $10,000 and the excess price or loading can be computed as follows:

= ($12,000/120) × 20

= $2,000

or

100 units × $20

= $2,000

Working note 3: Calculation of excess price or loading on closing stock:

= (1,800/120) × 20

= $300

Or

15 units × $20

= $300

COMMENT YOUR SUGGESTIONS

click the follow button in this blog site, comment your ideas, and like to page and subscribe to our official YouTube channel

Thank you.

FOLLOW US.

Presenting by -Accounting way

for more information -

follow "accounting way" official face book accoun

No comments:

Post a Comment