"You will can get notification in to your G mail ,when we are upload our new article . so you can follow this blog site. you can see "follow button on the top line of the blog page, click it. "

Audit Process

Introduction to Inventory and Cost of Goods Sold

Inventory is merchandise purchased by merchandisers (retailers, wholesalers, distributors) for the purpose of being sold to customers. The cost of the merchandise purchased but not yet sold is reported in the account Inventory or Merchandise Inventory.

Inventory is reported as a current asset on the company's balance sheet. Inventory is a significant asset that needs to be monitored closely. Too much inventory can result in cash flow problems, additional expenses (e.g., storage, insurance), and losses if the items become obsolete. Too little inventory can result in lost sales and lost customers.

Because of the cost principle, inventory is reported on the balance sheet at the amount paid to obtain (purchase) the merchandise, not at its selling price.

Inventory is also a significant asset of manufacturers. However, in order to simplify our explanation, we will focus on a retailer.

Cost of Goods Sold

Cost of goods sold is the cost of the merchandise that was sold to customers. The cost of goods sold is reported on the income statement when the sales revenues of the goods sold are reported.

A retailer's cost of goods sold includes the cost from its supplier plus any additional costs necessary to get the merchandise into inventory and ready for sale. For example, let's assume that Corner Shelf Bookstore purchases a college textbook from a publisher. If Corner Shelf's cost from the publisher is $80 for the textbook plus $5 in shipping costs, Corner Shelf reports $85 in its Inventory account until the book is sold. When the book is sold, the $85 is removed from inventory and is reported as cost of goods sold on the income statement.

When Costs Change

If the publisher increases the selling prices of its books, the bookstore will have a higher cost for the next book it purchases from the publisher. Any books in the bookstore's inventory will continue to be reported at their cost when purchased. For example, if the Corner Shelf Bookstore has on its shelf a book that had a cost of $85, Corner Shelf will continue to report the cost of that one book at its actual cost of $85 even if the same book now has a cost of $90. The cost principle will not allow an amount higher than cost to be included in inventory.

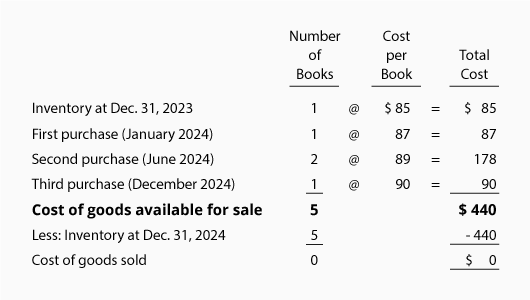

Let's assume the Corner Shelf Bookstore had one book in inventory at the start of the year 2019 and at different times during 2019 purchased four identical books. During the year 2019 the cost of these books increased due to a paper shortage. The following chart shows the costs of the five books that have to be accounted for. It also assumes that none of the books has been sold as of December 31, 2019.

Cost Flow Assumptions

If the Corner Shelf Bookstore sells only one of the five books, which cost should Corner Shelf report as the cost of goods sold? Should it select $85, $87, $89, $89, $90, or an average of the five amounts? A related question is which cost should Corner Shelf report as inventory on its balance sheet for the four books that have not been sold?

Accounting rules allow the bookstore to move the cost from inventory to the cost of goods sold by using one of three cost flows:

- First In, First Out (FIFO)

- Last In, First Out (LIFO)

- Average

Note that these are cost flow assumptions. This means that the order in which costs are removed from inventory can be different from the order in which the goods are physically removed from inventory. In other words, Corner Shelf could sell the book that was on hand at December 31, 2018 but could remove from inventory the $90 cost of the book purchased in December 2019 (if it elects the LIFO cost flow assumption).

Inventory Systems

Each of the three cost flow assumptions listed above can be used in either of two systems (or methods) of inventory:

A. Periodic

B. Perpetual

A. Periodic inventory system. Under this system the amount appearing in the Inventory account is not updated when purchases of merchandise are made from suppliers. Rather, the Inventory account is commonly updated or adjusted only once—at the end of the year. During the year the Inventory account will likely show only the cost of inventory at the end of the previous year.

Under the periodic inventory system, purchases of merchandise are recorded in one or more Purchases accounts. At the end of the year the Purchases account(s) are closed and the Inventory account is adjusted to equal the cost of the merchandise actually on hand at the end of the year. Under the periodic system there is no Cost of Goods Sold account to be updated when a sale of merchandise occurs.

In short, under the periodic inventory system there is no way to tell from the general ledger accounts the amount of inventory or the cost of goods sold.

B. Perpetual inventory system. Under this system the Inventory account is continuously updated. The Inventory account is increased with the cost of merchandise purchased from suppliers and it is reduced by the cost of merchandise that has been sold to customers. (The Purchases account(s) do not exist.)

Under the perpetual system there is a Cost of Goods Sold account that is debited at the time of each sale for the cost of the merchandise that was sold. Under the perpetual system a sale of merchandise will result in two journal entries: one to record the sale and the cash or accounts receivable, and one to reduce inventory and to increase cost of goods sold.

Inventory Systems and Cost Flows Combined

The combination of the three cost flow assumptions and the two inventory systems results in six available options when accounting for the cost of inventory and calculating the cost of goods sold:

A1. Periodic FIFO

A2. Periodic LIFO

A3. Periodic Average

B1. Perpetual FIFO

B2. Perpetual LIFO

B3. Perpetual Average

A1. Periodic FIFO

"Periodic" means that the Inventory account is not routinely updated during the accounting period. Instead, the cost of merchandise purchased from suppliers is debited to an account called Purchases. At the end of the accounting year the Inventory account is adjusted to equal the cost of the merchandise that has not been sold. The cost of goods sold that will be reported on the income statement will be computed by taking the cost of the goods purchased and subtracting the increase in inventory (or adding the decrease in inventory).

"FIFO" is an acronym for First In, First Out. Under the FIFO cost flow assumption, the first (oldest) costs are the first ones to leave inventory and become the cost of goods sold on the income statement. The last (or recent) costs will be reported as inventory on the balance sheet.

Remember that the costs can flow differently than the goods. If the Corner Shelf Bookstore uses FIFO, the owner may sell the newest book to a customer, but is allowed to report the cost of goods sold as $85 (the first, oldest cost).

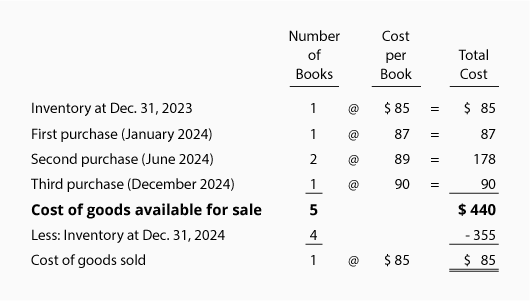

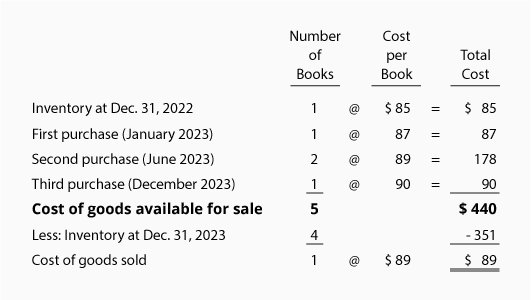

Let's illustrate periodic FIFO with the amounts from the Corner Shelf Bookstore:

As before, we need to account for the total goods available for sale (5 books at a cost of $440). Under FIFO we assign the first cost of $85 to the one book that was sold. The remaining $355 ($440 - $85) is assigned to inventory. The $355 of inventory costs consists of $87 + $89 + $89 + $90. The $85 cost assigned to the book sold is permanently gone from inventory.

If Corner Shelf Bookstore sells the textbook for $110, its gross profit under periodic FIFO will be $25 ($110 - $85). If the costs of textbooks continue to increase, FIFO will always result in more profit than other cost flows, because the first cost is always lower.

A2. Periodic LIFO

"Periodic" means that the Inventory account is not updated during the accounting period. Instead, the cost of merchandise purchased from suppliers is debited to an account called Purchases. At the end of the accounting year the Inventory account is adjusted to equal the cost of the merchandise that is unsold. The other costs of goods will be reported on the income statement as the cost of goods sold.

"LIFO" is an acronym for Last In, First Out. Under the LIFO cost flow assumption, the last (or recent) costs are the first ones to leave inventory and become the cost of goods sold on the income statement. The first (or oldest) costs will be reported as inventory on the balance sheet.

Remember that the costs can flow differently than the goods. In other words, if Corner Shelf Bookstore uses LIFO, the owner may sell the oldest (first) book to a customer, but can report the cost of goods sold of $90 (the last cost).

It's important to note that under LIFO periodic (not LIFO perpetual) we wait until the entire year is over before assigning the costs. Then we flow the year's last costs first, even if those goods arrived after the last sale of the year. For example, assume the last sale of the year at the Corner Shelf Bookstore occurred on December 27. Also assume that the store's last purchase of the year arrived on December 31. Under LIFO periodic, the cost of the book purchased on December 31 is sent to the cost of goods sold first, even though it's physically impossible for that book to be the one sold on December 27. (This reinforces our previous statement that the flow of costs does not have to correspond with the physical flow of units.)

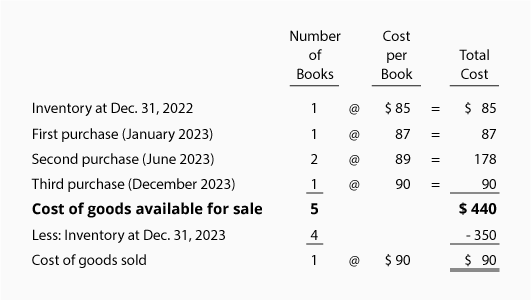

Let's illustrate periodic LIFO by using the data for the Corner Shelf Bookstore:

As before we need to account for the total goods available for sale: 5 books at a cost of $440. Under periodic LIFO we assign the last cost of $90 to the one book that was sold. (If two books were sold, $90 would be assigned to the first book and $89 to the second book.) The remaining $350 ($440 - $90) is assigned to inventory. The $350 of inventory cost consists of $85 + $87 + $89 + $89. The $90 assigned to the book that was sold is permanently gone from inventory.

If the bookstore sold the textbook for $110, its gross profit under periodic LIFO will be $20 ($110 - $90). If the costs of textbooks continue to increase, LIFO will always result in the least amount of profit. (The reason is that the last costs will always be higher than the first costs. Higher costs result in less profits and usually lower income taxes.)

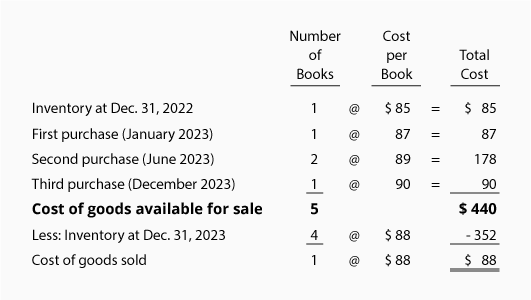

A3. Periodic Average

Under "periodic" the Inventory account is not updated and purchases of merchandise are recorded in an account called Purchases. Under this cost flow assumption an average cost is calculated using the total goods available for sale (cost from the beginning inventory plus the costs of all subsequent purchases made during the entire year). In other words, the periodic average cost is calculated after the year is over—after all the purchases of the year have occurred. This average cost is then applied to the units sold during the year as well as to the units in inventory at the end of the year.

As you can see, our facts remain the same-there are 5 books available for sale for the year 2019 and the cost of the goods available is $440. The weighted average cost of the books is $88 ($440 of cost of goods available ÷ 5 books available) and it is used for both the cost of goods sold and for the cost of the books in inventory.

Since the bookstore sold only one book, the cost of goods sold is $88 (1 x $88). The four books still on hand are reported at $352 (4 x $88) of cost in the Inventory account. The total of the cost of goods sold plus the cost of the inventory should equal the total cost of goods available ($88 + $352 = $440).

If Corner Shelf Bookstore sells the textbook for $110, its gross profit under the periodic average method will be $22 ($110 - $88). This gross profit is between the $25 computed under periodic FIFO and the $20 computed under periodic LIFO.

B1. Perpetual FIFO

Under the perpetual system the Inventory account is constantly (or perpetually) changing. When a retailer purchases merchandise, the retailer debits its Inventory account for the cost; when the retailer sells the merchandise to its customers its Inventory account is credited and its Cost of Goods Sold account is debited for the cost of the goods sold. Rather than staying dormant as it does with the periodic method, the Inventory account balance is continuously updated.

Under the perpetual system, two transactions are recorded when merchandise is sold: (1) the sales amount is debited to Accounts Receivable or Cash and is credited to Sales, and (2) the cost of the merchandise sold is debited to Cost of Goods Sold and is credited to Inventory. (Note: Under the periodic system the second entry is not made.)

With perpetual FIFO, the first (or oldest) costs are the first moved from the Inventory account and debited to the Cost of Goods Sold account. The end result under perpetual FIFO is the same as under periodic FIFO. In other words, the first costs are the same whether you move the cost out of inventory with each sale (perpetual) or whether you wait until the year is over (periodic).

B2. Perpetual LIFO

Under the perpetual system the Inventory account is constantly (or perpetually) changing. When a retailer purchases merchandise, the retailer debits its Inventory account for the cost of the merchandise. When the retailer sells the merchandise to its customers, the retailer credits its Inventory account for the cost of the goods that were sold and debits its Cost of Goods Sold account for their cost. Rather than staying dormant as it does with the periodic method, the Inventory account balance is continuously updated.

Under the perpetual system, two transactions are recorded at the time that the merchandise is sold: (1) the sales amount is debited to Accounts Receivable or Cash and is credited to Sales, and (2) the cost of the merchandise sold is debited to Cost of Goods Sold and is credited to Inventory. (Note: Under the periodic system the second entry is not made.)

With perpetual LIFO, the last costs available at the time of the sale are the first to be removed from the Inventory account and debited to the Cost of Goods Sold account. Since this is the perpetual system we cannot wait until the end of the year to determine the last cost—an entry must be recorded at the time of the sale in order to reduce the Inventory account and to increase the Cost of Goods Sold account.

If costs continue to rise throughout the entire year, perpetual LIFO will yield a lower cost of goods sold and a higher net income than periodic LIFO. Generally this means that periodic LIFO will result in less income taxes than perpetual LIFO. (If you wish to minimize the amount paid in income taxes during periods of inflation, you should discuss LIFO with your tax adviser.)

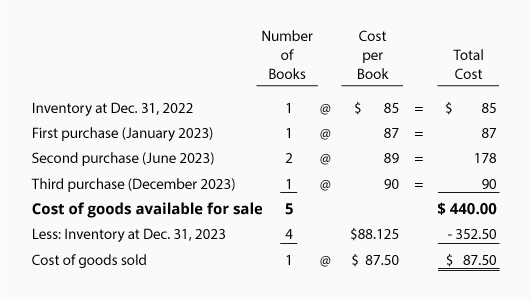

Once again we'll use our example for the Corner Shelf Bookstore:

Let's assume that after Corner Shelf makes its second purchase in June 2019, Corner Shelf sells one book. This means the last cost at the time of the sale was $89. Under perpetual LIFO the following entry must be made at the time of the sale: $89 will be credited to Inventory and $89 will be debited to Cost of Goods Sold. If that was the only book sold during the year, at the end of the year the Cost of Goods Sold account will have a balance of $89 and the cost in the Inventory account will be $351 ($85 + $87 + $89 + $90).

If the bookstore sells the textbook for $110, its gross profit under perpetual LIFO will be $21 ($110 - $89). Note that this is different than the gross profit of $20 under periodic LIFO.

B3. Perpetual Average

Under the perpetual system the Inventory account is constantly (or perpetually) changing. When a retailer purchases merchandise, the costs are debited to its Inventory account; when the retailer sells the merchandise to its customers the Inventory account is credited and the Cost of Goods Sold account is debited for the cost of the goods sold. Rather than staying dormant as it does with the periodic method, the Inventory account balance under the perpetual average is changing whenever a purchase or sale occurs.

Under the perpetual system, two sets of entries are made whenever merchandise is sold: (1) the sales amount is debited to Accounts Receivable or Cash and is credited to Sales, and (2) the cost of the merchandise sold is debited to Cost of Goods Sold and is credited to Inventory. (Note: Under the periodic system the second entry is not made.)

Under the perpetual system, "average" means the average cost of the items in inventory as of the date of the sale. This average cost is multiplied by the number of units sold and is removed from the Inventory account and debited to the Cost of Goods Sold account. We use the average as of the time of the sale because this is a perpetual method. (Note: Under the periodic system we wait until the year is over before computing the average cost.)

Let's use the same example again for the Corner Shelf Bookstore:

Let's assume that after Corner Shelf makes its second purchase, Corner Shelf sells one book. This means the average cost at the time of the sale was $87.50 ([$85 + $87 + $89 + $89] ÷ 4]). Because this is a perpetual average, a journal entry must be made at the time of the sale for $87.50. The $87.50 (the average cost at the time of the sale) is credited to Inventory and is debited to Cost of Goods Sold. After the sale of one unit, three units remain in inventory and the balance in the Inventory account will be $262.50 (3 books at an average cost of $87.50).

After Corner Shelf makes its third purchase, the average cost per unit will change to $88.125 ([$262.50 + $90] ÷ 4). As you can see, the average cost moved from $87.50 to $88.125—this is why the perpetual average method is sometimes referred to as the moving average method. The Inventory balance is $352.50 (4 books with an average cost of $88.125 each).

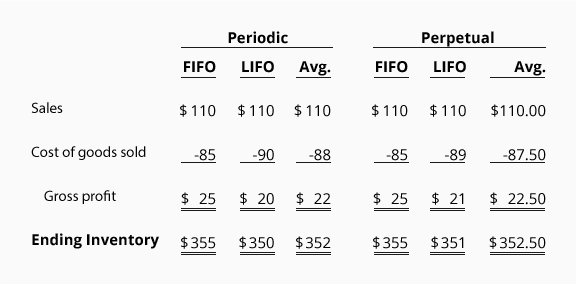

Comparison of Cost Flow Assumptions

Below is a recap of the varying amounts for the cost of goods sold, gross profit, and ending inventory that were calculated above.

The example assumes that costs were continually increasing. The results would be different if costs were decreasing or increasing at a slower rate. Consult with your tax advisor concerning the election of cost flow assumption.

Inventory Management

Over the past few decades sophisticated companies have made great strides in reducing their levels of inventory. Rather than carry large inventories, they ask their suppliers to deliver goods "just in time." Suppliers and merchandisers have learned to coordinate their purchases and sales so that orders and shipments occur automatically.

A company will realize significant benefits if it can keep its inventory levels down without losing sales or production (if the company is a manufacturer). For example, Dell Computers has greatly reduced its inventory in relationship to its sales. Since computer components have been dropping in costs as new technologies emerge, it benefits Dell to keep only a very small inventory of components on hand. It would be a financial hardship if Dell had a large quantity of parts that became obsolete or decreased in value.

Estimating Ending Inventory

It is very time-consuming for a company to physically count the merchandise units in its inventory. In fact, it is not unusual for companies to shut down their operations near the end of their accounting year just to perform inventory counts. The company may assign one set of employees to count and tag the items and another set to verify the counts. If a company has outside auditors, they will be there to observe the process. (Even if the company's computers keep track of inventory, accountants require that the computer records be verified by actually counting the goods.)

If a company counts its inventory only once per year it must estimate its inventory at the end of each month in order to prepare meaningful monthly financial statements. In fact, a company may need to estimate its inventory for other reasons as well. For example, if a company suffers a loss due to a disaster such as a tornado or a fire, it will need to file a claim for the approximate cost of the inventory that was lost. (An insurance adjuster will also compute this amount independently so that the company is not paid too much or too little for its loss.)

Methods of Estimating Inventory

There are two methods for estimating ending inventory:

1. Gross Profit Method

2. Retail Method

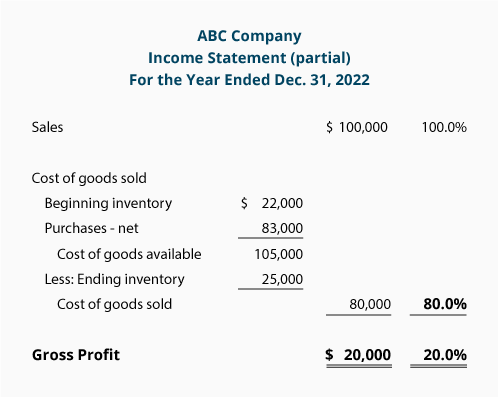

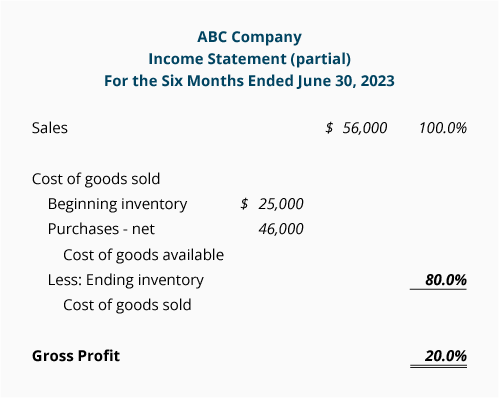

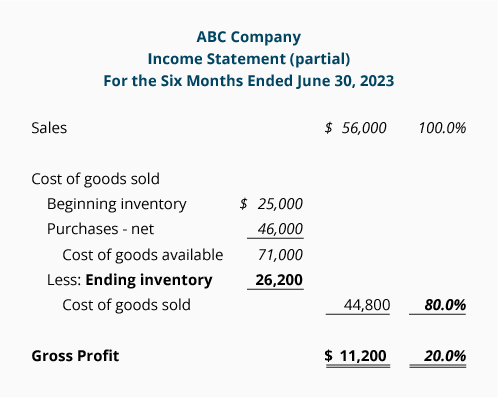

1. Gross Profit Method. The gross profit method for estimating inventory uses the information contained in the top portion of a merchandiser's multiple-step income statement:

Let's assume that we need to estimate the cost of inventory on hand on June 30, 2019. From the 2018 income statement shown above we can see that the company's gross profit is 20% of the sales and that the cost of goods sold is 80% of the sales. If those percentages are reasonable for the current year, we can use those percentages to help us estimate the cost of the inventory on hand as of June 30, 2019.

While an algebraic equation could be constructed to determine the estimated amount of ending inventory, we prefer to simply use the income statement format. We prepare a partial income statement for the period beginning after the date when inventory was last physically counted, and ending with the date for which we need the estimated inventory cost. In this case, the income statement will go from January 1, 2019 until June 30, 2019.

Some of the numbers that we need are easily obtained from sales records, customers, suppliers, earlier financial statements, etc. For example, sales for the first half of the year 2019 are taken from the company's records. The beginning inventory amount is the ending inventory reported on the December 31, 2018 balance sheet. The purchases information for the first half of 2019 is available from the company's records or its suppliers. The amounts that we have available are written in italics in the following partial income statement:

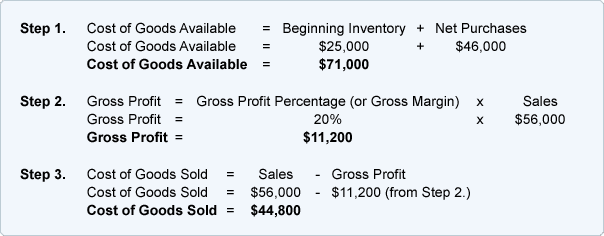

We will fill in the rest of the statement with the answers to the following calculations. The amounts in italics come from the statement above. The bold amount is the answer or result of the calculation.

This can also be calculated as 80% x Sales of $56,000 = $44,800.

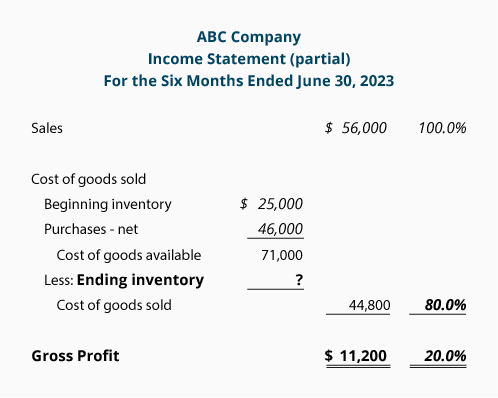

Inserting this information into the income statement yields the following:

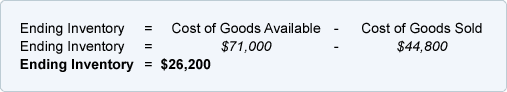

As you can see, the ending inventory amount is not yet shown. We compute this amount by subtracting cost of goods sold from the cost of goods available:

Below is the completed partial income statement with the estimated amount of ending inventory at $26,200. (Note: It is always a good idea to recheck the math on the income statement to be certain you computed the amounts correctly.)

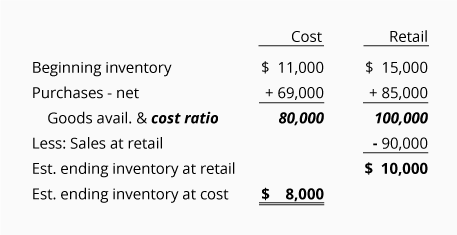

2. Retail Method. The retail method can be used by retailers who have their merchandise records in both cost and retail selling prices. A very simple illustration for using the retail method to estimate inventory is shown here:

As you can see, the cost amounts are arranged into one column. The retail amounts are listed in a separate column. The Goods Available amounts are used to compute the cost-to-retail ratio. In this case the cost of goods available of $80,000 is divided by the retail amount of goods available ($100,000). This results in a cost-to-retail ratio, or cost ratio, of 80%. To arrive at the estimated ending inventory at cost, we multiply the estimated ending inventory at retail ($10,000) times the cost ratio of 80% to arrive at $8,000

click the follow button in this blog site, comment your ideas, and like to page and subscribe to our official YouTube channel

Thank you.

FOLLOW US.

Presenting by -Accounting way

for more information -

follow "accounting way" official face book account

subscribe and click the bell icon, to "Accounting tutorials" YouTube channel for practicing knowledge

YouTube channel link mentioned below

https://www.youtube.com/channel/UCpe3Z6l310iM4RcZO1-2mlw

.

No comments:

Post a Comment