"You will can get notification in to your Gmail ,when we are upload our new article . so you can follow this blog site. you can see "follow button on the top line of the blog page, click it. "

Introduction to Accounts Payable

When a company orders and receives goods (or services) in advance of paying for them, we say that the company is purchasing the goods on account or on credit. The supplier (or vendor) of the goods on credit is also referred to as a creditor. If the company receiving the goods does not sign a promissory note, the vendor's bill or invoice will be recorded by the company in its liability account Accounts Payable (or Trade Payables).

As is expected for a liability account, Accounts Payable will normally have a credit balance. Hence, when a vendor invoice is recorded, Accounts Payable will be credited and another account must be debited (as required by double-entry accounting). When an account payable is paid, Accounts Payable will be debited and Cash will be credited. Therefore, the credit balance in Accounts Payable should be equal to the amount of vendor invoices that have been recorded but have not yet been paid.

Under the accrual method of accounting, the company receiving goods or services on credit must report the liability no later than the date they were received. The same date is used to record the debit entry to an expense or asset account as appropriate. Hence, accountants say that under the accrual method of accounting expenses are reported when they are incurred (not when they are paid).

The term accounts payable can also refer to the person or staff that processes vendor invoices and pays the company's bills. That's why a supplier who hasn't received payment from a customer will phone and ask to speak with "accounts payable."

The accounts payable process involves reviewing an enormous amount of detail to ensure that only legitimate and accurate amounts are entered in the accounting system. Much of the information that needs to be reviewed will be found in the following documents:

- purchase orders issued by the company

- receiving reports issued by the company

- invoices from the company's vendors

- contracts and other agreements

The accuracy and completeness of a company's financial statements are dependent on the accounts payable process. A well-run accounts payable process will include:

- the timely processing of accurate and legitimate vendor invoices,

- accurate recording in the appropriate general ledger accounts, and

- the accrual of obligations and expenses that have not yet been completely processed.

The efficiency and effectiveness of the accounts payable process will also affect the company's cash position, credit rating, and relationships with its suppliers.

An Account Payable Is Another Company's Account Receivable

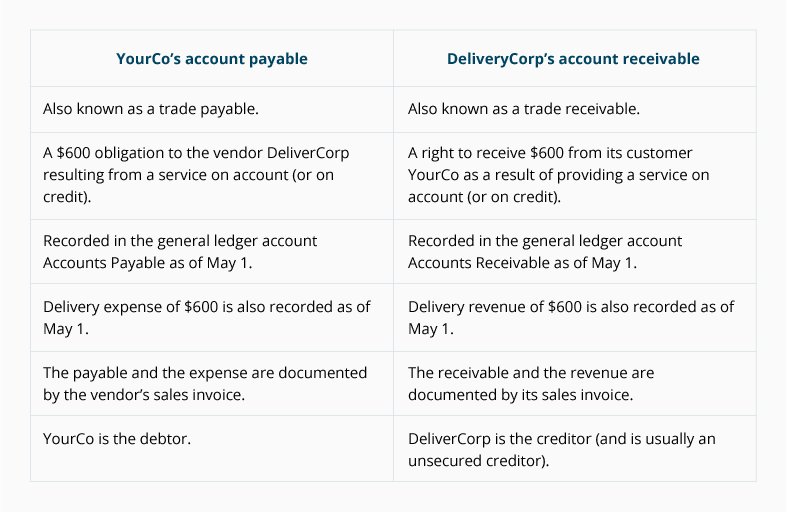

It may be helpful to note that an account payable at one company is an account receivable for the vendor that issued the sales invoice. To illustrate this, let's assume that Deliver Corp provides a service for Your Co at a cost of $600 on May 1 and sends an invoice dated May 1 for $600. The invoice specifies that the amount will be due in 30 days. (We will assume throughout our explanation that the companies follow the accrual method of accounting.)

The following table highlights the symmetry between a company's account payable and its vendor's account receivable.

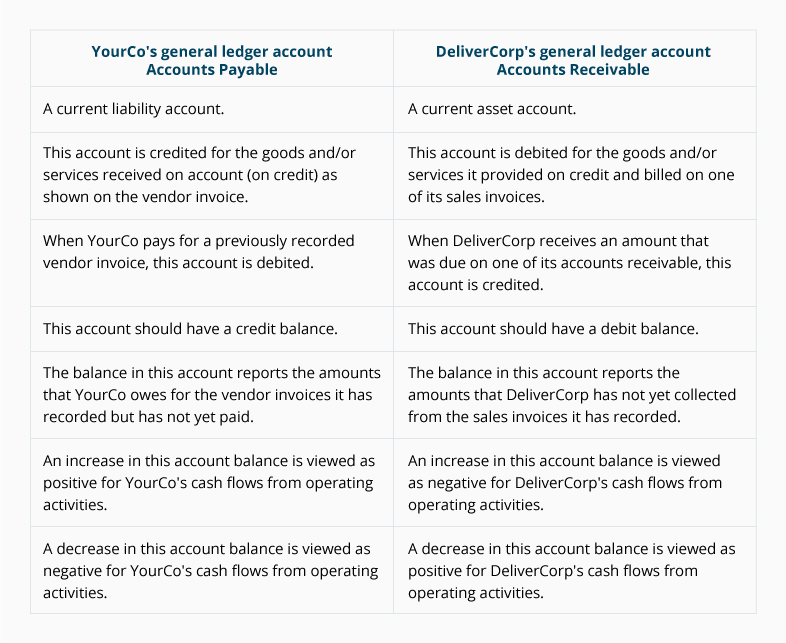

The following table focuses on the general ledger accounts: Accounts Payable and Accounts Receivable.

The accounts payable process or function is immensely important since it involves nearly all of a company's payments outside of payroll. The accounts payable process might be carried out by an accounts payable department in a large corporation, by a small staff in a medium-sized company, or by a bookkeeper or perhaps the owner in a small business.

Regardless of the company's size, the mission of accounts payable is to pay only the company's bills and invoices that are legitimate and accurate. This means that before a vendor's invoice is entered into the accounting records and scheduled for payment, the invoice must reflect:

- what the company had ordered

- what the company has received

- the proper unit costs, calculations, totals, terms, etc.

To safeguard a company's cash and other assets, the accounts payable process should have internal controls. A few reasons for internal controls are to:

- prevent paying a fraudulent invoice

- prevent paying an inaccurate invoice

- prevent paying a vendor invoice twice

- be certain that all vendor invoices are accounted for

Periodically companies should seek professional assistance to improve its internal controls.

The accounts payable process must also be efficient and accurate in order for the company's financial statements to be accurate and complete. Because of double-entry accounting an omission of a vendor invoice will actually cause two accounts to report incorrect amounts. For example, if a repair expense is not recorded in a timely manner:

- the liability will be omitted from the balance sheet, and

- the repair expense will be omitted from the income statement.

If the vendor invoice for a repair is recorded twice, there will be two problems as well:

- the liabilities will be overstated, and

- repairs expense will be overstated.

In other words, without the accounts payable process being up-to-date and well run, the company's management and other users of the financial statements will be receiving inaccurate feedback on the company's performance and financial position.

A poorly run accounts payable process can also mean missing a discount for paying some bills early. If vendor invoices are not paid when they become due, supplier relationships could be strained. This may lead to some vendors demanding cash on delivery. If that were to occur it could have extreme consequences for a cash-strapped company.

Just as delays in paying bills can cause problems, so could paying bills too soon. If vendor invoices are paid earlier than necessary, there may not be cash available to pay some other bills by their due dates.

Purchase order

A purchase order or PO is prepared by a company to communicate and document precisely what the company is ordering from a vendor. The paper version of a purchase order is a multi-copy form with copies distributed to several people. The people or departments receiving a copy of the PO include:

- the person requesting that a PO be issued for the goods or services

- the accounts payable department

- the receiving department

- the vendor

- the person preparing the purchase order

The purchase order will indicate a PO number, date prepared, company name, vendor name, name and phone number of a contact person, a description of the items being purchased, the quantity, unit prices, shipping method, date needed, and other pertinent information.

One copy of the purchase order will be used in the three-way match, which we will discuss later.

Receiving report

A receiving report is a company's documentation of the goods it has received. The receiving report may be a paper form or it may be a computer entry. The quantity and description of the goods shown on the receiving report should be compared to the information on the company's purchase order.

After the receiving report and purchase order information are reconciled, they need to be compared to the vendor invoice. Hence, the receiving report is the second of the three documents in the three-way match (which will be discussed shortly).

Vendor Invoice

The supplier or vendor will send an invoice to the company that had received the goods and/or services on credit. When the invoice or bill is received, the customer will refer to it as a vendor invoice. Each vendor invoice is routed to accounts payable for processing. After the invoice is verified and approved, the amount will be credited to the company's Accounts Payable account and will also be debited to another account (often as an expense or asset).

A common technique for verifying a vendor invoice is the three-way match.

Three-way match

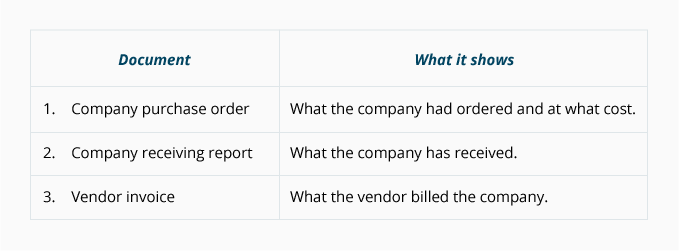

The accounts payable process often uses a technique known as the three-way match to assure that only valid and accurate vendor invoices are recorded and paid. The three-way match involves the following:

Only when the details in the three documents are in agreement will a vendor's invoice be entered into the Accounts Payable account and scheduled for payment.

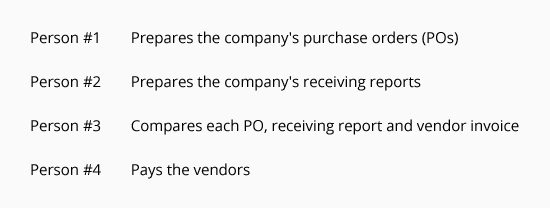

Good internal control of a company's resources is enhanced when the company assigns a separate employee with a specific, limited responsibility. The following chart illustrates the concept of the separation (or segregation) of duties involving accounts payable:

When the duties are separated, it will require more than one dishonest person to steal from the company. Hence, small companies without sufficient staff to separate employees' responsibilities will have a greater risk of theft.

To illustrate the three-way match, let's assume that Buyer Co needs 10 cartridges of toner for its printers. Buyer Co issues a purchase order to Supplier Corp for 10 cartridges at $60 per cartridge that are to be delivered in 10 days. One copy of the PO is sent to Supplier Corp, one copy goes to the person requisitioning the cartridges, one copy goes to the receiving department, one copy goes to accounts payable, and one copy is retained by the person preparing the PO. When Buyer Co receives the cartridges, a receiving report is prepared.

The three-way match involves comparing the following information:

- The description, quantity, cost and terms on the company's purchase order.

- The description and quantity of goods shown on the receiving report.

- The description, quantity, cost, terms, and math on the vendor invoice.

After determining that the information reconciles, the vendor invoice can be entered into the liability account Accounts Payable. The information entered into the accounting software will include invoice reference information (vendor name or code, invoice number and date, etc.), the amount to be credited to Accounts Payable, the amount(s) and account(s) to be debited and the date that the payment is to be made. The payment date is based on the terms shown on the invoice and the company's policy for making payments.

Lastly, the documents should be stamped or perforated to indicate they have been entered into the accounting system thus avoiding a duplicate payment.

Vouchers

Some companies use a voucher in order to document or "vouch for" the completeness of the approval process. You can visualize a voucher as a cover sheet for attaching the supporting documents (purchase order, receiving report, vendor's invoice, etc.) and for noting the approvals, account numbers, and other information for each vendor invoice or bill.

When the vendor invoice is paid, the voucher and its attachments (including a copy of the check that was issued) will be stored in a paid voucher/invoice file. If paper documents are involved, an office machine could perforate the word "PAID" through the voucher and its attachments. This is done to assure that a duplicate payment will not occur.

The unpaid invoices and vouchers will be held in an open file.

Vendor invoices without purchase orders or receiving reports

Not all vendor invoices will have purchase orders or receiving reports. Hence, the three-way match is not always possible. For example, a company does not issue a purchase order to its electric utility for a pre-established amount of electricity for the following month. The same is true for the telephone, natural gas, sewer and water, freight-in, and so on.

There are also payments that are required every month in order to fulfill lease agreements or other contracts. Examples include the monthly rent for a storage facility, office rent, automobile payments, equipment leases, maintenance agreements, etc. Even though these obligations will not have purchase orders, the responsibility is unchanged: pay only the amounts that are legitimate and accurate.

Statements from vendors

Vendors often send statements to their customers to indicate the amounts (listed by invoice number) that remain unpaid. When a vendor statement is received the details on the statement should be compared to the company's records.

The fact that a company can be receiving both invoices and statements from a vendor means there is the potential of a duplicate payment. In order to avoid making a duplicate payment, companies often establish the following rule: Pay only from vendor invoices; never pay from vendor statements.

Related Expense or Asset

The vendor invoices received by a company could involve the following:

A vendor invoice may be a bill for a repair or maintenance service. The vendor's credit terms allow the company to pay 30 days after the date of the service. Since repairs and maintenance do not create more assets, the cost of the service should be reported on the income statement as an expense. Under the accrual method of accounting the expense is reported in the accounting period in which the service occurred (not the period in which it is paid). Other examples of expenses include the cost of office expenses such as electricity and telephone, consulting, and more.

A vendor invoice may be a bill for the purchase of expensive equipment that will be used by the company for several years. The equipment will be recorded as an asset and will be reported in the company's balance sheet section property, plant and equipment. As the equipment is utilized, its cost will be moved from the balance sheet to the income statement account Depreciation Expense.

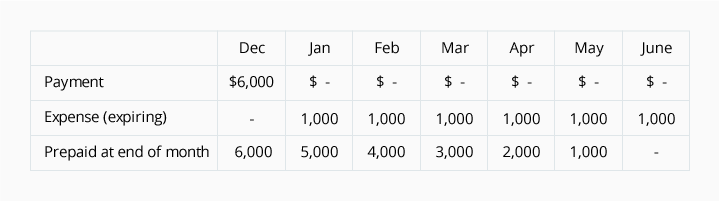

Another vendor invoice may be a billing for the cost of a service that the vendor will provide in the future, but the payment must be made in advance. A common example is an insurance company's invoice for the premiums covering the next six months of insurance on the company's automobiles. The company will initially debit the invoice amount to a current asset such as Prepaid Expenses. As the insurance expires, the cost will be allocated to Insurance Expense.

The following table illustrates an insurance premium of $6,000 that is paid in December but the coverage is for the following January 1 through June 30:

The three examples illustrate that some vendor invoices will be immediately recorded as expenses while other invoices are initially recorded as assets. The accounts payable staff needs to be instructed as to the proper accounts to be debited when vendor invoices are entered as credits to Accounts Payable. Generally, a cost that is used up and has no future economic value that can be measured is debited immediately to expense. Vendor invoices for property, plant and equipment are not expensed immediately. Instead, the cost is recorded in a balance sheet asset account and will be expensed in increments during the asset's useful life. Lastly, a prepaid expense is initially recorded in a current asset account and will be allocated to expense as the cost expires.

End of the Period Cut-Off

At the end of every accounting period (year, quarter, month, 5-week period, etc.) it is important that the accounts payable processing be up-to-date. If it is not up-to-date, the income statement for the accounting period will likely be omitting some expenses and the balance sheet at the end of the accounting period will be omitting some liabilities.

During the first few days after an accounting period ends, it is important for the accounts payable staff to closely examine the incoming vendor invoices. For example, a $900 repair bill received on January 6 may be a December repair expense and a liability as of December 31. Another vendor invoice received on January 6 may not have been an obligation as of December 31 and is actually a January expense.

It is also necessary to review the receiving reports that have not yet been matched to vendor invoices. If items were ordered and received prior to December 31, the amounts must be recorded as of December 31 through an accrual-type adjusting entry.

Note: The proper cut-off at the end of each accounting period becomes more complicated and often more significant if a company has inventories of finished products, work-in-process and raw materials. It is possible that some goods will be included in the physical inventory counts, but the costs have not yet been recorded in Accounts Payable and in the Inventory or Purchases account.

Accruing Expenses and Liabilities

At the end of every accounting period there will be some vendor invoices and receiving reports that have not yet been approved or fully matched. As a result these amounts will not have been entered into the Accounts Payable account (and the related expense or asset account). These documents should be reviewed in order to determine whether a liability and an expense have actually been incurred by the company as of the end of the accounting period.

Since the accrual method of accounting requires that all of a company's liabilities and expenses must be reported on the financial statements, companies should prepare an accrual-type adjusting entry at the end of every accounting period. This adjusting entry will credit Accrued Liabilities and will debit the appropriate expense or other account for the amounts that were incurred but are not yet included in Accounts Payable. The balance in Accrued Liabilities will be reported in the current liability section of the balance sheet immediately after Accounts Payable.

It is also common for companies to prepare a reversing entry every month. The reversing entry removes the previous period's accrual adjusting entry and prevents the double-counting of an expense that could occur when the actual vendor invoice is processed.

Note: Under the accrual method of accounting, a company's financial statements must report all expenses and liabilities that are probable and can be measured even if the vendors' invoices have not yet been received or fully processed.

Adding General Ledger Accounts

The general ledger accounts that are available for recording transactions are found in the company's chart of accounts. For most businesses the general ledger accounts are listed in the following order:

- Balance sheet accounts

- Asset accounts

- Liability accounts

- Stockholders' or owner's equity accounts

- Income statement accounts

- Operating revenue accounts

- Operating expense accounts

- Nonoperating revenue and gain accounts

- Nonoperating expense and loss accounts

Many systems will allow for each account to have subaccounts. Subaccounts allow for summarizing or combining amounts while also maintaining the detailed amounts.

When the existing accounts are not sufficient, new accounts should be added. In other words, meaningful financial reporting of transactions should not be limited to a preconceived list of accounts.

For more information and examples see Explanation of Chart of Accounts (search in our blogsite).

Invoice Credit Terms

The invoice terms indicate when an invoice becomes due and whether a discount may be taken if the invoice is paid sooner. The invoice terms also dictate the point at which ownership of goods will transfer from the seller to the buyer.

The following payment terms are some of the more common ones for businesses without inventories.

Net due upon receipt

If the vendor's terms are Net due upon receipt, the invoice amount is due immediately. (Of course, you should verify that the invoice is valid and accurate before it is entered for payment.)

Net 30 days

When the vendor invoice states Net 30 days, the amount of the invoice (minus any returns or allowances) is due 30 days from the date of the invoice. For example, if a vendor invoice for $1,000 is dated June 1 and the company is granted a $100 allowance, the net amount of $900 should be paid by July 1. (If there were no allowance, the company should remit $1,000 by July 1.)

1/10, n/30

When a vendor invoice includes terms of 1/10, n/30, the "1" represents 1% of the amount owed, the "10" represents 10 days, the "n" represents the word net, and the "30" represents 30 days. The terms 1/10, n/30 indicate that the buyer may take an early payment discount of 1% of the amount owed if the amount owed is remitted within 10 days instead of the normal 30 days. In other words, the buyer can choose either of the following:

- Pay within 10 days and deduct 1% of the net amount owed (the invoice amount minus any authorized returns and/or allowances), or

- Pay in 30 days and take no discount.

To illustrate1/10, n/30, let's assume that a vendor invoice for $1,000 is dated June 1 and the buyer does not return any of the goods. Since there are no returns, the net amount of the purchase is the full $1,000 and the buyer can remit either of the following amounts:

- If paying by June 10, the amount due to the vendor is $990. [The net amount of $1,000 minus the $10 early payment discount (which is 1% of $1,000).]

- If paying by July 1, the net amount of $1,000 is due.

If the buyer was given an allowance of $100, the net amount is $900. In that case the buyer can remit either of the following amounts:

- If paying by June 10, the amount due to the vendor is $891. [The net amount of $900 minus $9 (which is 1% of $900).]

- If paying by July 1, the net amount of $900 is due.

2/10, n/30

If the vendor's invoice has terms of 2/10, n/30, the "2" represents 2%, the "10" represents 10 days, the "n" represents the word net and the "30" represents 30 days. This means that the buyer can take an early payment discount of 2% of the amount owed if the amount is remitted within 10 days instead of the customary 30 days. In other words, the buyer can choose either of the following:

- Pay within 10 days and deduct 2% of the net amount (invoice amount minus any authorized returns and/or allowances), or

- Pay the full amount in 30 days with no discount.

To illustrate 2/10, n/30, assume that a vendor's invoice for $1,000 is dated June 1 and the vendor has granted the buyer an allowance of $100. This means the net amount is $900 and that only $900 will be eligible for the early payment discount. Hence, the buyer can remit either of the following amounts:

- If paying by June 10, the amount due to the vendor is $882. [The net amount of $900 minus $18 (which is 2% of $900).]

- If paying by July 1, the net amount of $900 is due.

Early Payment Discounts vs. Need for Cash

Some vendors offer an early payment discount such as 2/10, net 30. This means that the buyer may deduct 2% of the amount owed if the vendor is paid within 10 days instead of the normal 30 days. For instance, an invoice amount of $1,000 can be settled in full if the buyer will pay $980 within 10 days. In this example, the buyer will save $20 (2% X $1,000) for paying 20 days earlier than the normal due date. If the buyer has the opportunity to do this every 20 days, it would occur 18 times during a year (365 days divided by 20 days = 18 times). That means the company could save up to $360 ($20 X 18 times per year) each year by using a single $980 amount. Hence the annual percentage rate is approximately 36% ($360 earned divided by $980 used).

Looking at it another way, if the buyer had to borrow $980 from its bank for the 20 days at a borrowing rate of 6% per year, the interest for 20 days would be only $3.22 ($980 X 6% X 20/365). By paying $3.22 of interest to the bank, the buyer will save paying the vendor $20 and therefore will be better off by $16.78 ($20.00 minus $3.22). If this occurs 18 times in a year, the net annual savings will be approximately $301 [$16.78 X 18 times; or $360 per year saved minus the annual interest paid to the bank of $59 ($980 X 6%)].

A discount of 1% for paying 20 days early equates to an annual interest rate of approximately 18%.

It is clear that buyers with sufficient cash balances or a readily available line of credit should take advantage of the early payment discounts. However, some buyers are operating with very little cash and are unable to borrow additional money. These buyers may be wise to forgo the early payment discounts in order to avoid the risk of overdrawing their checking account. One overdraft fee could be greater than the early payment discount. If an overdraft causes several of the buyer's checks to be returned to its vendors, the total amount of overdraft fees will be even greater.

If a buyer's checks are returned because of insufficient funds its suppliers may become concerned about the buyer's ability to pay. This could lead to one or more of the suppliers demanding payment at the time of delivery. The elimination of 30 days of credit from suppliers could be devastating for a buyer with little money and a credit line that has been exhausted.

Be sure to consider your company's cash balances and cash needs before paying invoices prior to their due dates.

Internal controls

In order to protect a company's assets it is important that a company have in place a variety of controls over issuing purchase orders, issuing checks, adding vendors to the accounts payable master vendor file, segregating duties, and other safeguards referred to as internal controls.

We recommend that a professional who is well-versed in internal controls perform a review of your company's policies and procedures.

Batching the payments to vendors

In order for the accounts payable staff to operate efficiently, it is helpful to process the checks written to vendors only on specified days each month. Writing the checks on pre-announced days will hopefully discourage the need for "rush" checks and allow the accounts payable processing to be more efficient.

Sales and use taxes

Certain purchases of goods and/or services may be subject to state sales taxes. If a sales tax is not paid for the sales-taxable goods or services (even from out-of-state vendors), the buyer is likely to be liable for a state use tax. To further complicate the situation, some organizations may be exempt from both a sales tax and a use tax depending on the state laws.

The responsibility for compliance with sales and use taxes rests with each company. As a result, companies must be familiar with the laws of the states in which they operate.

General Ledger Account: Accounts Payable

The general ledger account Accounts Payable or Trade Payables is a current liability account, since the amounts owed are usually due in 10 days, 30 days, 60 days, etc. The balance in Accounts Payable is usually presented as the first or second item in the current liability section of the balance sheet. (Many companies report Notes Payable due within one year as the first item.)

As a liability account, Accounts Payable is expected to have a credit balance. Hence, a credit entry will increase the balance in Accounts Payable and a debit entry will decrease the balance.

A bill or invoice from a supplier of goods or services on credit is often referred to as a vendor invoice. The vendor invoices are entered as credits in the Accounts Payable account, thereby increasing the credit balance in Accounts Payable. When a company pays a vendor, it will reduce Accounts Payable with a debit amount. As a result, the normal credit balance in Accounts Payable is the amount of vendor invoices that have been recorded but have not yet been paid. The unpaid invoices are sometimes referred to as open invoices.

Accounting software allows companies to sort its accounts payable according to the dates when payments will be due. This feature and the resulting report are known as the aging of accounts payable.

Entering a vendor invoice into Accounts Payable

Prior to entering a vendor invoice into Accounts Payable, the invoice should be reviewed and approved. The reason is that a vendor invoice may contain errors (incorrect quantities, incorrect prices, math errors, etc.) and some invoices may not be legitimate.

After a vendor invoice has been approved, the recording of the invoice will include:

- a credit to Accounts Payable, and

- a minimum of one debit to another account. The debit amount usually involves one of the following:

- an expense (Repairs & Maintenance Expense, Advertising Expense, Rent Expense, etc.)

- a prepaid asset (Prepaid Expenses, Prepaid Insurance)

- a fixed or plant asset (Equipment, Fixtures, Vehicles, etc.)

A listing of the accounts that a company has available for recording transactions is known as the chart of accounts.

A report that lists the accounts and amounts that are debited for a group of invoices entered into the accounting software is known as the accounts payable distribution.

Reductions to Accounts Payable

When a company pays part or all of a previously recorded vendor invoice, the balance in Accounts Payable will be reduced with a debit entry and Cash will be reduced with a credit entry.

Accounts Payable is also debited when a company returns goods to a vendor or when the vendor grants an allowance.

click the follow button in this blog site, comment your ideas, and like to page and subscribe to our official YouTube channel

Thank you.

FOLLOW US.

Presenting by -Accounting way

for more information -

follow "accounting way" official face book account

subscribe and click the bell icon, to "Accounting Way" YouTube channel for practicing knowledge

YouTube channel link mentioned below

https://www.youtube.com/channel/UCpe3Z6l310iM4RcZO1-2mlw

No comments:

Post a Comment