"You will can get notification in to your G mail ,when we are upload our new article . so you can follow this blog site. you can see "blank line" on the top line of the blog page, type your gmail and then submit. "

Audit Process

Introduction to Accounts Receivable and Bad Debts Expense

If we imagine buying something, such as groceries, it's easy to picture ourselves standing at the checkout, writing out a personal check, and taking possession of the goods. It's a simple transaction—we exchange our money for the store's groceries.

In the world of business, however, many companies must be willing to sell their goods (or services) on credit. This would be equivalent to the grocer transferring ownership of the groceries to you, issuing a sales invoice, and allowing you to pay for the groceries at a later date.

Whenever a seller decides to offer its goods or services on credit, two things happen:

(1) the seller boosts its potential to increase revenues since many buyers appreciate the convenience and efficiency of making purchases on credit, and

(2) the seller opens itself up to potential losses if its customers do not pay the sales invoice amount when it becomes due.

Under the accrual basis of accounting (which we will be using throughout our discussion) a sale on credit will:

- Increase sales or sales revenues, which are reported on the income statement, and

- Increase the amount due from customers, which is reported as accounts receivable—an asset reported on the balance sheet.

If a buyer does not pay the amount it owes, the seller will report:

- A credit loss or bad debts expense on its income statement, and

- A reduction of accounts receivable on its balance sheet.

With respect to financial statements, the seller should report its estimated credit losses as soon as possible using the allowance method. For income tax purposes, however, losses are reported at a later date through the use of the direct write-off method.

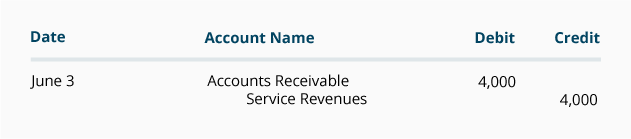

Recording Services Provided on Credit

Assume that on June 3, Malloy Design Co. provides $4,000 of graphic design service to one of its clients with credit terms of net 30 days. (Providing services with credit terms is also referred to as providing services on account.)

Under the accrual basis of accounting, revenues are considered earned at the time when the services are provided. This means that on June 3 Malloy will record the revenues it earned, even though Malloy will not receive the $4,000 until July. Below are the accounts affected on June 3, the day the service transaction was completed:

In this transaction, the debit to Accounts Receivable increases Malloy's current assets, total assets, working capital, and stockholders' (or owner's) equity—all of which are reported on its balance sheet. The credit to Service Revenues will increase Malloy's revenues and net income—both of which are reported on its income statement.

Recording Sales of Goods on Credit

When a company sells goods on credit, it reports the transaction on both its income statement and its balance sheet. On the income statement, increases are reported in sales revenues, cost of goods sold, and (possibly) expenses. On the balance sheet, an increase is reported in accounts receivable, a decrease is reported in inventory, and a change is reported in stockholders' equity for the amount of the net income earned on the sale.

If the sale is made with the terms FOB Shipping Point, the ownership of the goods is transferred at the seller's dock. If the sale is made with the terms FOB Destination, the ownership of the goods is transferred at the buyer's dock.

In principle, the seller should record the sales transaction when the ownership of the goods is transferred to the buyer. Practically speaking, however, accountants typically record the transaction at the time the sales invoice is prepared and the goods are shipped.

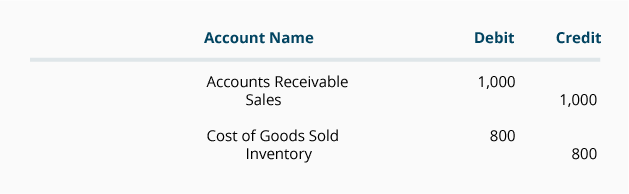

FOB Shipping Point

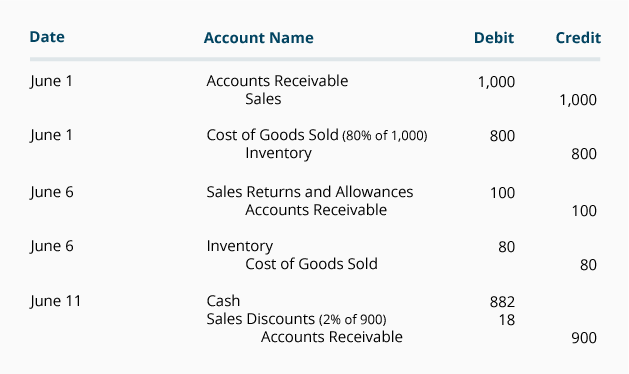

Quality Products Co. just sold and shipped $1,000 worth of goods using the terms FOB Shipping Point. With its cost of goods at 80% of sales value, Quality makes the following entries in its general ledger:

(While there may be additional expenses with this transaction—such as commission expense—we are not considering them in our example.)

FOB Shipping Point means the ownership of the goods is transferred to the buyer at the seller's dock. This means that the buyer is responsible for transporting the goods from Quality Product's shipping dock. Therefore, all shipping costs (as well as any damage that might be incurred during transit) are the responsibility of the buyer.

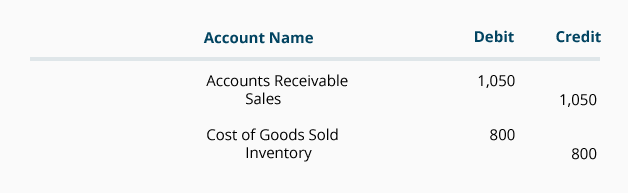

FOB Destination

FOB Destination means the ownership of the goods is transferred at the buyer's dock. This means the seller is responsible for transporting the goods to the customer's dock, and will factor in the cost of shipping when it sets its price for the goods.

Let's assume that Gem Merchandise Co. makes a sale to a customer that has a sales value of $1,050 and a cost of goods sold at $800. This transaction affects the following accounts in Gem's general ledger:

Because Gem chooses to ship its goods FOB Destination, the ownership of the goods transfers at the buyer's dock. Therefore, Gem Merchandise assumes all the risks and costs associated with transporting the goods.

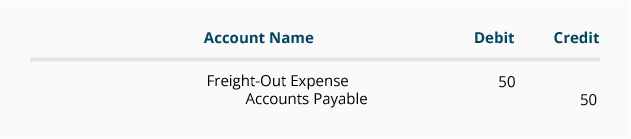

Now let's assume that Gem pays an independent shipping company $50 to transport the goods from its warehouse to the buyer's dock. Gem records the $50 as an operating expense or selling expense (in an account such as Delivery Expense, Freight-Out Expense, or Transportation-Out Expense). If the shipping company allows Gem to pay in 7 days, Gem will make the following entry in its general ledger:

Credit Terms with Discounts

When a seller offers credit terms of net 30 days, the net amount for the sales transaction is due 30 days after the sales invoice date.

To illustrate the meaning of net, assume that Gem Merchandise Co. sells $1,000 of goods to a customer. Upon receiving the goods the customer finds that $100 of the goods are not acceptable. The customer contacts Gem and is instructed to return the unacceptable goods. This means that Gem's net sale ends up being $900; the customer's net purchase will also be $900 ($1,000 minus the $100 returned). It also means that Gem's net receivable from this customer will be $900.

Unfortunately, companies who sell on credit often find that they don't receive payments from customers on time. In fact, one study found that if the credit term is net 30 days, the money, on average, arrived 45 days after the invoice date. In order to speed up these payments, some companies give credit terms that offer a discount to those customers who pay within a shorter period of time. The discount is referred to as a sales discount, cash discount, or an early payment discount, and the shorter period of time is known as the discount period. For example, the term 2/10, net 30 allows a customer to deduct 2% of the net amount owed if the customer pays within 10 days of the invoice date. If a customer does not pay within the discount period of 10 days, the net purchase amount (without the discount) is due 30 days after the invoice date.

Using the example from above, let's illustrate how the credit term of 2/10, net 30 works. Gem Merchandise Co. ships $1,000 of goods and the customer returns $100 of unacceptable goods to Gem within a few days. At that point, the net amount owed by the customer is $900. If the customer pays Gem within 10 days of the invoice date, the customer is allowed to deduct $18 (2% of $900) from the net purchase of $900. In other words, the $900 amount can be settled for $882 if it is paid within the 10-day discount period.

Let's assume that the sale above took place on the first day that Gem was open for business, June 1. On June 6 Gem receives the returned goods and restocks them, and on June 11 it receives $882 from the buyer. Gem's cost of goods is 80% of their original selling prices (before discounts). The above transactions are reflected in Gem's general ledger as follows:

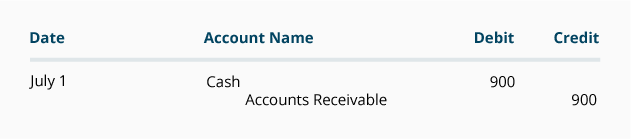

If the customer waits 30 days to pay Gem, the June 11 entry shown above will not occur. In its place will be the following entry on July 1:

Examples of Amounts Due Under Varying Credit Terms

The following chart shows the amounts a seller would receive under various credit terms for a merchandise sale of $1,000 and an authorized return of $100 of goods.

| Credit Terms | Brief Description | Amount To Be Received |

| Net 10 days | The net amount is due within 10 days of the invoice date. | $900 |

| Net 30 days | The net amount is due within 30 days of the invoice date. | $900 |

| Net 60 days | The net amount is due within 60 days of the invoice date. | $900 |

| 2/10, n/30 | If paid within 10 days of the invoice date, the buyer may deduct 2% from the net amount. ($900 minus $18) | $882 |

| 2/10, n/30 | If paid in 30 days of the invoice date, the net amount is due. | $900 |

| 1/10, n/60 | If paid within 10 days of the invoice date, the buyer may deduct 1% from the net amount. ($900 minus $9) | $891 |

| 1/10, n/60 | If paid in 60 days of the invoice date, the net amount is due. | $900 |

| Net EOM 10 | The net amount is due within 10 days after the end of the month (EOM). In other words, payment for any sale made in June is due by July 10. | $900 |

Costs of Discounts

Some people believe that the credit term of 2/10, net 30 is far too generous. They argue that when a $900 receivable is settled for $882 (simply because the customer pays 20 days early) the seller is, in effect, giving the buyer the equivalent of a 36% annual interest rate (2% for 20 days equates to 36% for 360 days). Some sellers won't offer terms such as 2/10, net 30 because of these high percentage equivalents. Other sellers are discouraged to find that some customers take the discount and ignore the obligation to pay within the stated discount period.

Credit Risk

When a seller provides goods or services on credit, the resultant account receivable is normally considered to be an unsecured claim against the buyer's assets. This makes the seller (the supplier) an unsecured creditor, meaning it does not have a lien on any of the buyer's assets—not even on the goods that it just sold to the buyer.

Sometimes a supplier's customer gets into financial difficulty and is forced to liquidate its assets. In this situation the customer typically owes money to lending institutions as well as to its suppliers of goods and services. In such cases, it's the secured creditors (the banks and other lenders that have a lien on specific assets such as cash, receivables, inventory, equipment, etc.) who are paid first from the sale of the assets. Often there is not enough money to pay what is owed to the secured lenders, much less the unsecured creditors. In other words, the suppliers will never be paid what they are owed.

To avoid this kind of risk, some suppliers may decide not to sell anything on credit, but require instead that all of its goods be paid for with cash or a credit card. Such a company, however, may lose out on sales to competitors who offer to sell on credit.

To minimize losses, sellers typically perform a thorough credit check on any new customer before selling to them on credit. They obtain credit reports and check furnished references. Even when a credit check is favorable, however, a credit loss can still occur. For example, a first-rate customer may experience an unexpected financial hardship caused by one of its customers, something that could not have been known when the credit check was done. The point is this: any company that sells on credit to a large number of customers should assume that, sooner or later, it will probably experience some credit losses along the way.

Allowance Method for Reporting Credit Losses

Accounts receivable are reported as a current asset on a company's balance sheet. Since current assets by definition are expected to turn to cash within one year (or within the operating cycle, whichever is longer), a company's balance sheet could overstate its accounts receivable (and therefore its working capital and stockholders' equity) if any part of its accounts receivable is not collectible.

To guard against overstatement, a company will estimate how much of its accounts receivable will never be collected. This estimate is reported in a balance sheet contra asset account called Allowance for Doubtful Accounts. (Some companies call this account Provision for Doubtful Accounts or Allowance for Uncollectible Accounts.) Any increases to Allowance for Doubtful Accounts are also recorded in the income statement account Bad Debts Expense (or Uncollectible Accounts Expense).

This method of anticipating the uncollectible amount of receivables and recording it in the Allowance for Doubtful Accounts is known as the allowance method. (If a company does not use an allowance account, it is following the direct write-off method, which is discussed later.)

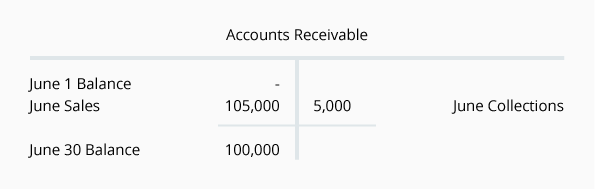

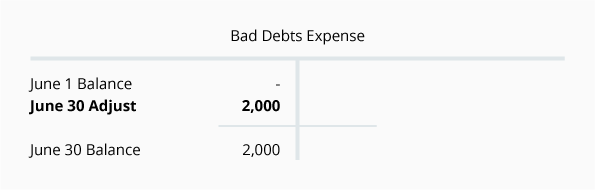

Allowance for Doubtful Accounts and Bad Debts Expense - June

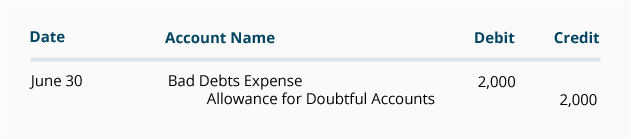

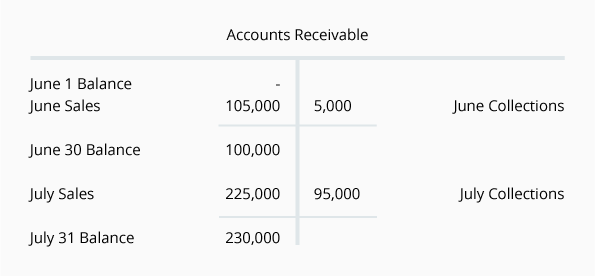

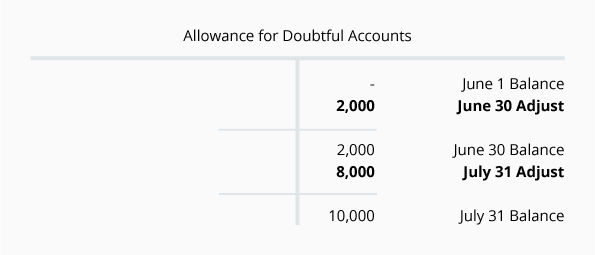

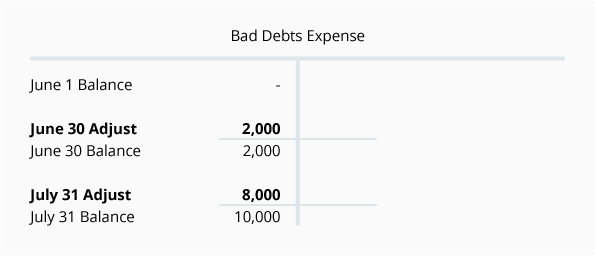

As we stated above, the account Allowance for Doubtful Accounts is a contra asset account containing the estimated amount of the accounts receivable that will not be collected. For example, let's assume that Gem Merchandise Co.'s Accounts Receivable has a debit balance of $100,000 at June 30. Gem anticipates that approximately $2,000 of this is not likely to turn to cash, and as a result, Gem reports a credit balance of $2,000 in Allowance for Doubtful Accounts. The accounting entry to adjust the balance in the allowance account will involve the income statement account Bad Debts Expense.

Since June was Gem's first month in business, its Allowance for Doubtful Accounts began June with a zero balance. At June 30, when it issues its first balance sheet and income statement, its Allowance for Doubtful Accounts will have a credit balance of $2,000. This is done using the following adjusting journal entry:

Here are some of the accounts in a T-account format:

With Allowance for Doubtful Accounts now reporting a credit balance of $2,000 and Accounts Receivable reporting a debit balance of $100,000, Gem's balance sheet will report a net amount of $98,000. Since this net amount of $98,000 is the amount that is likely to turn to cash, it is referred to as the net realizable value of the accounts receivable.

Under the allowance method, the Gem Merchandise Co. does not need to know specifically which customer will not pay, nor does it need to know the exact amount. This is acceptable because accountants believe it is better to report an approximate amount that is uncollectible rather than imply that every penny of the accounts receivable will be collected.

Gem's Bad Debts Expense will report credit losses of $2,000 on its June income statement. This expense is being reported even though none of the accounts receivables were due in June. (Recall the credit terms were net 30 days.) Gem is attempting to follow the matching principle by matching the bad debts expense as best it can to the accounting period in which the credit sales took place.

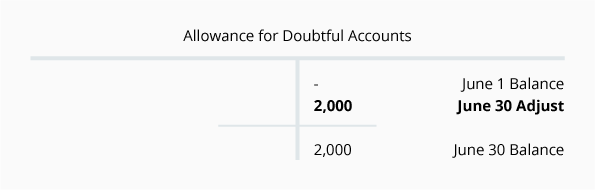

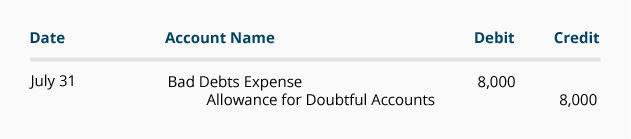

Allowance for Doubtful Accounts and Bad Debts Expense - July

Now let's assume that at July 31 the Gem Merchandise Co. has a debit balance in Accounts Receivable of $230,000. (The balance increased during July by the amount of its credit sales and it decreased by the amount it collected from customers.) The Allowance for Uncollectible Accounts still has the credit balance of $2,000 from the adjustment on June 30. This means Gem's general ledger accounts before the July 31 adjustment to Allowance for Uncollectible Accounts will be reporting a net realizable value of $228,000 ($230,000 minus $2,000).

Gem reviews the details of its accounts receivable and estimates that as of July 31 approximately $10,000 of the $230,000 will not be collectible. In other words, the net realizable value (or net cash value) of its accounts receivable as of July 31 is only $220,000 ($230,000 minus $10,000). Before the July 31 financial statements are released, Gem must adjust the Allowance for Doubtful Accounts so that its ending balance is a credit of $10,000 (instead of the present credit balance of $2,000). This requires the following adjusting entry:

After this journal entry is recorded, Gem's July 31 balance sheet will report the net realizable value of its accounts receivables at $220,000 ($230,000 debit balance in Accounts Receivable minus the $10,000 credit balance in Allowance for Doubtful Accounts).

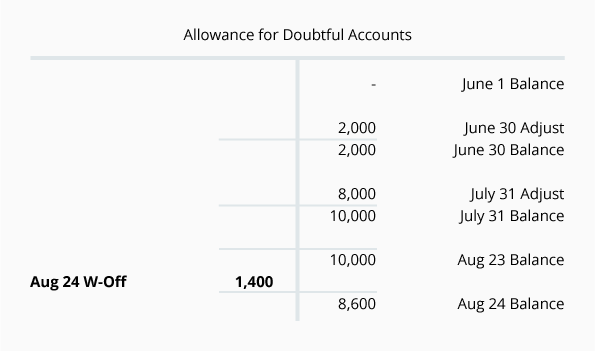

Here's a recap in T-account form:

As seen in the T-accounts above, Gem estimated that the total bad debts expense for the first two months of operations (June and July) is $10,000. It is likely that as of July 31 Gem will not know the precise amount of actual bad debts, nor will Gem know which customers are the ones that won't be paying their account balances. However, the matching principle is better met by Gem making these estimates and recording the credit loss as close as possible to the time the sales were made.

By reporting the $10,000 credit balance in Allowance for Doubtful Accounts, Gem is also adhering to the accounting principle of conservatism. In other words, if there is some doubt as to whether there are $10,000 of credit losses or no credit losses, Gem's accountant "breaks the tie" by choosing the alternative that reports a smaller amount of profit and a smaller amount of assets. (It is reporting a net realizable value of $220,000 instead of the $230,000 of accounts receivable.) If a company knows with certainty that every penny of its accounts receivable will be collected, then the Allowance for Doubtful Accounts will report a zero balance. However, if it is likely that some of the accounts receivable will not be collected in full, the principle of conservatism requires that there be a credit balance in Allowance for Doubtful Accounts.

Writing Off an Account under the Allowance Method

Under the allowance method, if a specific customer's accounts receivable is identified as uncollectible, it is written off by removing the amount from Accounts Receivable. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. No expense or loss is reported on the income statement because this write-off is "covered" under the earlier adjusting entries for estimated bad debts expense.

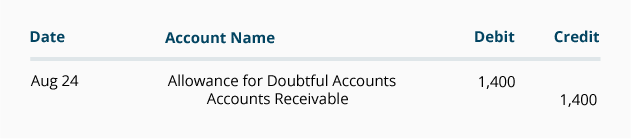

Let's illustrate the write-off with the following example. On June 3, a customer purchases $1,400 of goods on credit from Gem Merchandise Co. On August 24, that same customer informs Gem Merchandise Co. that it has filed for bankruptcy. The customer states that its bank has a lien on all of its assets. It also states that the liquidation value of those assets is less than the amount it owes the bank, and as a result Gem will receive nothing toward its $1,400 accounts receivable. After confirming this information, Gem concludes that it should remove, or write off, the customer's account balance of $1,400.

Under the allowance method of recording credit losses, Gem's entry to write off the customer's account balance is as follows:

The two accounts affected by this entry contain this information:

Note that prior to the August 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in Accounts Receivable and $10,000 credit balance in Allowance for Doubtful Accounts). After writing off the bad account on August 24, the net realizable value of the accounts receivable is still $230,000 ($238,600 debit balance in Accounts Receivable and $8,600 credit balance in Allowance for Doubtful Accounts).

The Bad Debts Expense remains at $10,000; it is not directly affected by the journal entry write-off. The bad debts expense recorded on June 30 and July 31 had anticipated a credit loss such as this. It would be double counting for Gem to record both an anticipated estimate of a credit loss and the actual credit loss.

Recovery of Account under Allowance Method

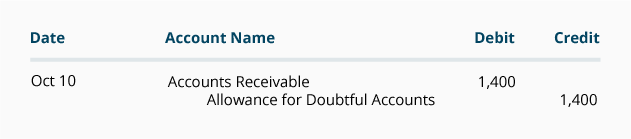

After a seller has written off an accounts receivable, it is possible that the seller is paid part or all of the account balance that was written off. Under the allowance method, if such a payment is received (whether directly from the customer or as a result of a court action) the seller will take the following two steps:

Reinstate the account that was written off by reversing the write-off entry. If we assume that the $1,400 written off on Aug 24 is collected on October 10, the reinstatement of the account looks like this:

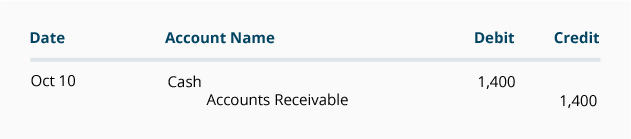

Process the $1,400 received on October 10:

The seller's accounting records now show that the account receivable was paid, making it more likely that the seller might do future business with this customer.

Bad Debts Expense as a Percent of Sales

Another way sellers apply the allowance method of recording bad debts expense is by using the percentage of credit sales approach. This approach automatically expenses a percentage of its credit sales based on past history.

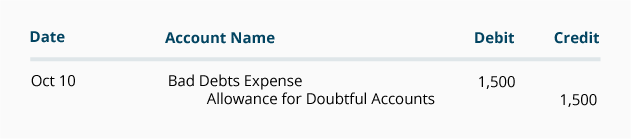

For example, let's assume that a company prepares weekly financial statements. Past experience indicates that 0.3% of its sales on credit will never be collected. Using the percentage of credit sales approach, this company automatically debits Bad Debts Expense and credits Allowance for Doubtful Accounts for 0.3% of each week's credit sales. Let's assume that in the current week this company sells $500,000 of goods on credit. It estimates its bad debts expense to be $1,500 (0.003 x $500,000) and records the following journal entry:

The percentage of credit sales approach focuses on the income statement and the matching principle. Sales revenues of $500,000 are immediately matched with $1,500 of bad debts expense. The balance in the account Allowance for Doubtful Accounts is ignored at the time of the weekly entries. However, at some later date, the balance in the allowance account must be reviewed and perhaps further adjusted, so that the balance sheet will report the correct net realizable value. If the seller is a new company, it might calculate its bad debts expense by using an industry average until it develops its own experience rate.

Difference between Expense and Allowance

The account Bad Debts Expense reports the credit losses that occur during the period of time covered by the income statement. Bad Debts Expense is a temporary account on the income statement, meaning it is closed at the end of each accounting year. (Closed means the account balance is transferred to retained earnings, perhaps through an income summary account.) By closing Bad Debts Expense and resetting its balance to zero, the account is ready to receive and tally the credit losses for the next accounting year.

The Allowance for Doubtful Accounts reports on the balance sheet the estimated amount of uncollectible accounts that are included in Accounts Receivable. Balance sheet accounts are almost always permanent accounts, meaning their balances carry forward to the next accounting period. In other words, they are not closed and their balances are not reset to zero.

Because the Bad Debts Expense account is closed each year, while the Allowance for Doubtful Accounts is not, these two balances will most likely not be equal after the company's first year of operations.

For example, let's assume that at the end of its first year of operations a company's Bad Debts Expense had a debit balance of $14,000 and its Allowance for Doubtful Accounts had a credit balance of $14,000. Because the income statement account balances are closed at the end of the year, the company's opening balance in Bad Debts Expense for the second year of operations is $0. The credit balance of $14,000 in Allowance for Doubtful Accounts, however, carries forward to the second year. If an adjusting entry of $3,000 is made during year 2, Bad Debts Expense will report a $3,000 debit balance, while Allowance for Doubtful Accounts might report a credit balance of $17,000.

Again, the reasons for the account balance differences are 1) Bad Debts Expense is a temporary account that reports credit losses only for the period shown on the income statement, and 2) Allowance for Doubtful Accounts is a permanent account that reports an estimated amount for all of the uncollectible receivables reported in the asset Accounts Receivable as of the balance sheet date.

Aging of Accounts Receivable

The general ledger account Accounts Receivable usually contains only summary amounts and is referred to as a control account. The details for the control account—each credit sale for every customer—is found in the subsidiary ledger for Accounts Receivable. The total amount of all the details in the subsidiary ledger must be equal to the total amount reported in the control account.

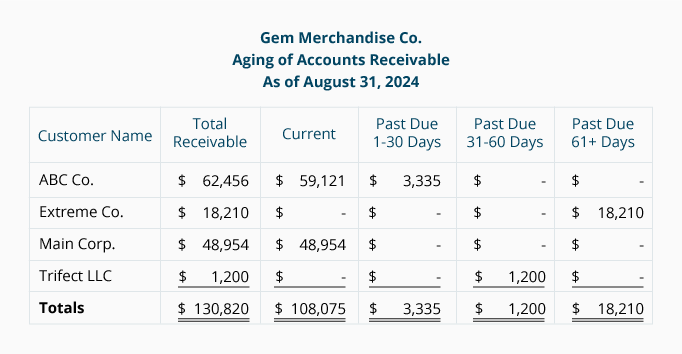

The detailed information in the accounts receivable subsidiary ledger is used to prepare a report known as the aging of accounts receivable. This report directs management's attention to accounts that are slow to pay. It is also useful in determining the balance amount needed in the account Allowance for Doubtful Accounts.

The aging of accounts receivable report is typically generated by sorting unpaid sales invoices in the subsidiary ledger—first by customer and then by the date of the sales invoices. If a company sells merchandise (or provides services) and allows customers to pay 30 days later, this report will indicate how much of its accounts receivable is past due. It also reports how far past due the accounts are.

With the click of a mouse, most accounting software will provide the aging of accounts receivable report. For example, Gem Merchandise Co.'s software looks at each of its customer's accounts receivable activity and compares the date of each unpaid sales invoice to the date of the report. If we assume the report is dated August 31 and that Gem's credit terms are net 30 days, any unpaid sales invoices with an August date will be classified as current. Any unpaid invoices with a date in July are classified as 1 - 30 days past due. Any unpaid invoices with a date of June are classified as 31 - 60 days past due, and so on. The sorted information is present in a report that looks similar to the following:

If a customer realizes that one of its suppliers is lax about collecting its account receivable on time, it may take advantage by further postponing payment in order to pay more demanding suppliers on time. This puts the seller at risk since an older, unpaid accounts receivable is more likely to end up as a credit loss. The aging of accounts receivable report helps management monitor and collect the accounts receivable in a more timely manner.

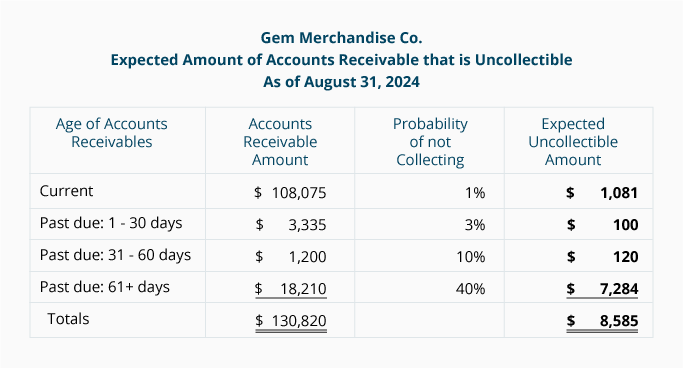

Aging Used in Calculating the Allowance

The aging of accounts receivable can also be used to estimate the credit balance needed in a company's Allowance for Doubtful Accounts. For example, based on past experience, a company might make the assumption that accounts not past due have a 99% probability of being collected in full. Accounts that are 1-30 days past due have a 97% probability of being collected in full, and the accounts 31-60 days past due have a 90% probability. The company estimates that accounts more than 60 days past due have only a 60% chance of being collected. With these probabilities of collection, the probability of not collecting is 1%, 3%, 10%, and 40% respectively.

If we multiply the totals from the aging of accounts receivable report by the probabilities of not collecting, we arrive at the expected amount of uncollectible receivables. This is illustrated below:

This computation estimates the balance needed for Allowance for Doubtful Accounts at August 31 to be a credit balance of $8,585.

Mailing Statements to Customers

To improve the probability of collection (and avoid bad debts expense) many sellers prepare and mail monthly statements to all customers that have accounts receivable balances. If worded skillfully, the seller can use the statement to say "thank you for your continued business" while at the same time "reminding" the customer that receivables are being monitored and payment is expected. To further prompt customers to pay in a timely manner, the statement may indicate that past due accounts are assessed interest at an annual rate of 18% (1.5% per month). Because transactions are usually itemized on the statement, some customers use the statement as a means to compare its records with those of the seller.

Pledging or Selling Accounts Receivable

A company's accounts receivable are considered to be a type of asset, and as such can be pledged as collateral for a loan. Asset-based lenders will often lend a company an amount equal to 80% of the value of its accounts receivable.

Some companies sell their accounts receivable to a factor. A factor buys the accounts receivables at a discount and then goes about the business of collecting and keeping the money owed through the receivables. Sometimes the factor will purchase the accounts receivables with recourse. This means the company that sold the receivables remains financially responsible if a customer does not remit the full amount to the factor. When the factor purchases the receivables without recourse, the company selling the receivables is not responsible for unpaid amounts.

Accounts Receivable Ratios

There are two commonly used financial ratios that address the relationship between the amount of a company's accounts receivable as reported on the balance sheet and the amount of credit sales as reported on the income statement. These ratios are:

- Accounts receivable turnover ratio, and

- Days sales in accounts receivable.

Direct Write-off Method

Generally accepted accounting principles (GAAP) require that companies use the allowance method when preparing financial statements. The use of the allowance method is not permitted, however, for purposes of reporting income taxes in the United States because the Internal Revenue Service (IRS) does not allow companies to anticipate these credit losses. As a result, companies must use the direct write-off method for income tax reporting.

In the direct write-off method, a company will not use an allowance account to reduce its Accounts Receivable. Accounts Receivable is only reduced if and when a company knows with certainty that a specific amount will not be collected from a specific customer.

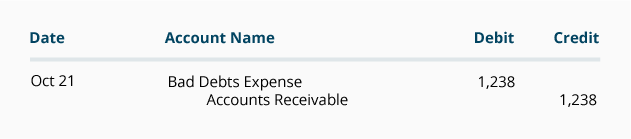

For example, let's assume that on October 21, Gem Merchandise Co. is convinced that a specific customer's account receivable originating on June 5 in the amount of $1,238 is definitely uncollectible. Using the direct write-off method, the following entry is made:

Usually many months will pass between the time of the sale on credit and the time that the seller knows with certainty that a customer is not going to pay. It is difficult to adhere to the matching principle and the concept of conservatism when a significant amount of time elapses between the time of the sales revenues and the time that the bad debts expense is reported. This is why, for purposes of financial reporting (not tax reporting), companies should use the allowance method rather than the direct write-off method.

click the follow button in this blog site, comment your ideas, and like to page and subscribe to our official YouTube channel

Thank you.

FOLLOW US.

Presenting by -Accounting way

for more information -

follow "accounting way" official face book account

subscribe and click the bell icon, to "Accounting Way" YouTube channel for practicing knowledge

YouTube channel link mentioned below

No comments:

Post a Comment